Real Estate

Understand your markets and stakeholders in new ways to uncover new opportunities at the intersection of growth and impact.

Explore our Case Studies:

Real Estate

Explore our Case Studies:

Real Estate Fund Advisory

Scenario

Leading partner to top 25 real estate private equity fund managers lacks standard training and tooling for ESG S.

Client Challenge

Head of ESG for the top advisory firm engaged with 25 leading real estate private equity funds needs a robust framework for training/advising fund managers on how to measure and manage the S in ESG. Firm’s current training program covers E and G effectively, but nothing exists for the S, which is currently a significant risk and opportunity.

EQ Solution

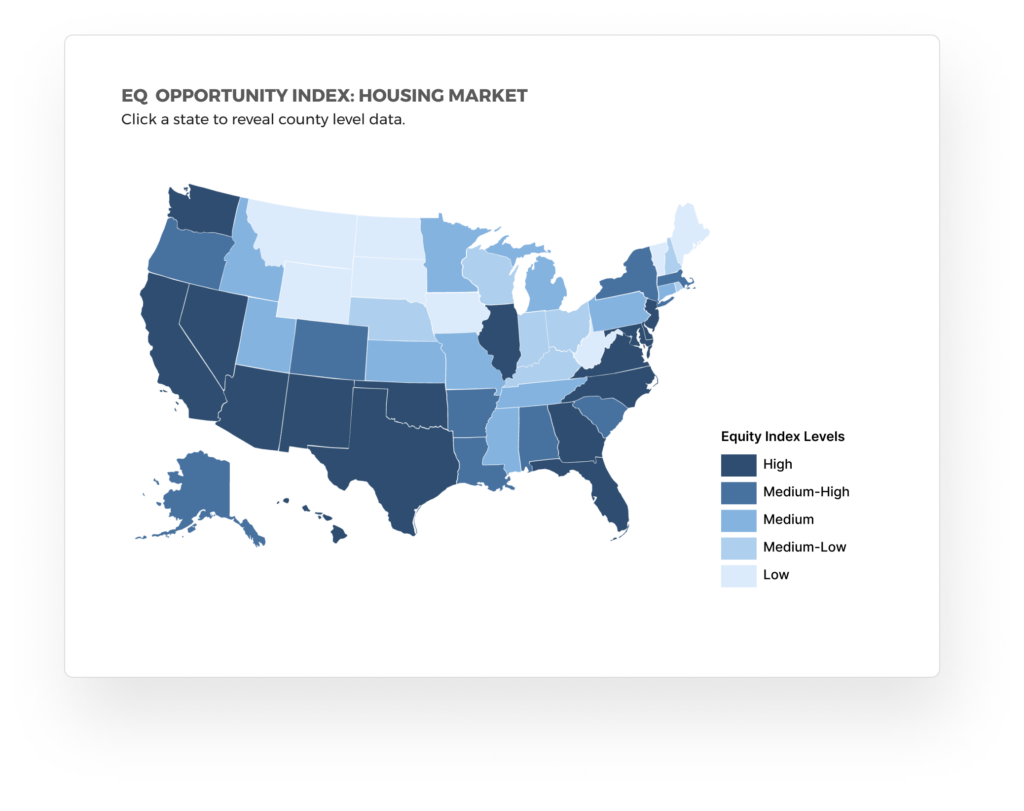

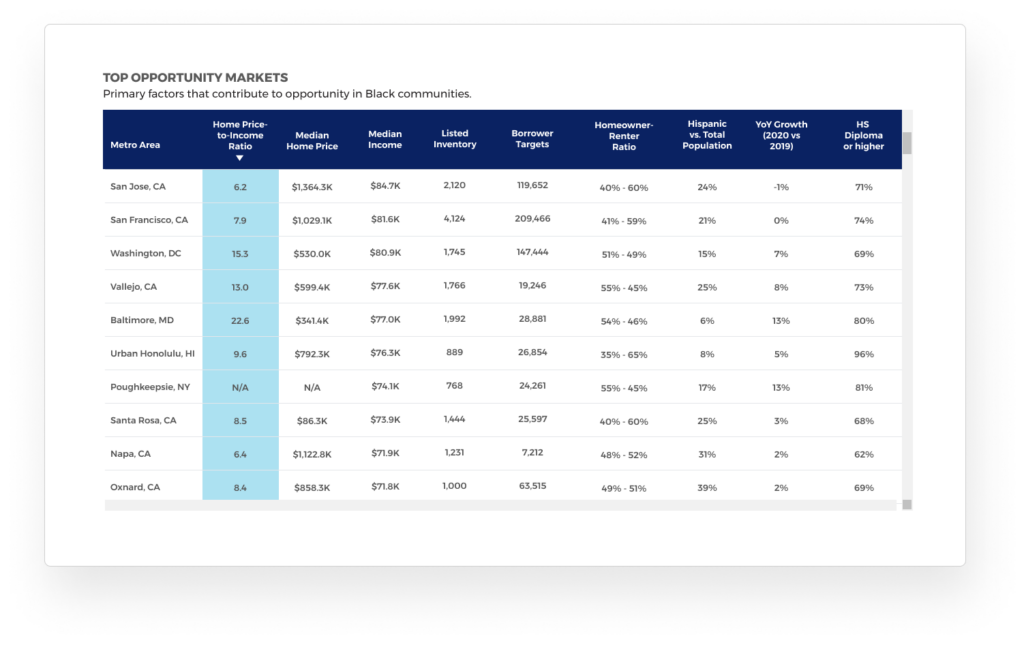

EQ Opportunity Index for Real Estate provides first standardized approach for helping clients measure and manage the S in ESG across their portfolio companies. This standardized, quantitative approach will enable real estate investment fund managers to achieve stronger fundraising success with 89% of LPs that consider ESG impact metrics in their evaluations.

A dashboard that optimizes decision making

First S standard

EQ Opportunity Index for Real Estate provides a standardized approach for PE funds to understand and report on portfolio companies, including individual companies and development projects as well as summary rollups by firm or benchmarking across the portfolio.

Portfolio tracking

Investment managers can automatically track performance and impact metrics over time all all levels, from project to portfolio, making it possible to proactively manage risk and see opportunities.

Automated reporting

Operationalized analytics enables an automated reporting engine that will save time and money, improve efficacy of audited data, and improve business success more broadly.

Turn insights into action and impact!

Optimize strategy

in top 5 regions with highest opportunity.

Track ROI & impact

by project to align xfunctional teams on execution KPIs.

Centralize reporting

for ESG surveys, impact LPs, regulatory filings, auditors, tenants/ communities.