We’re charting the future of Health Equity with HFMA Read the Press Release

Banking

Explore our Case Studies:

Banking

Explore our Case Studies:

Learn how Equity Quotient can create opportunities for your business.

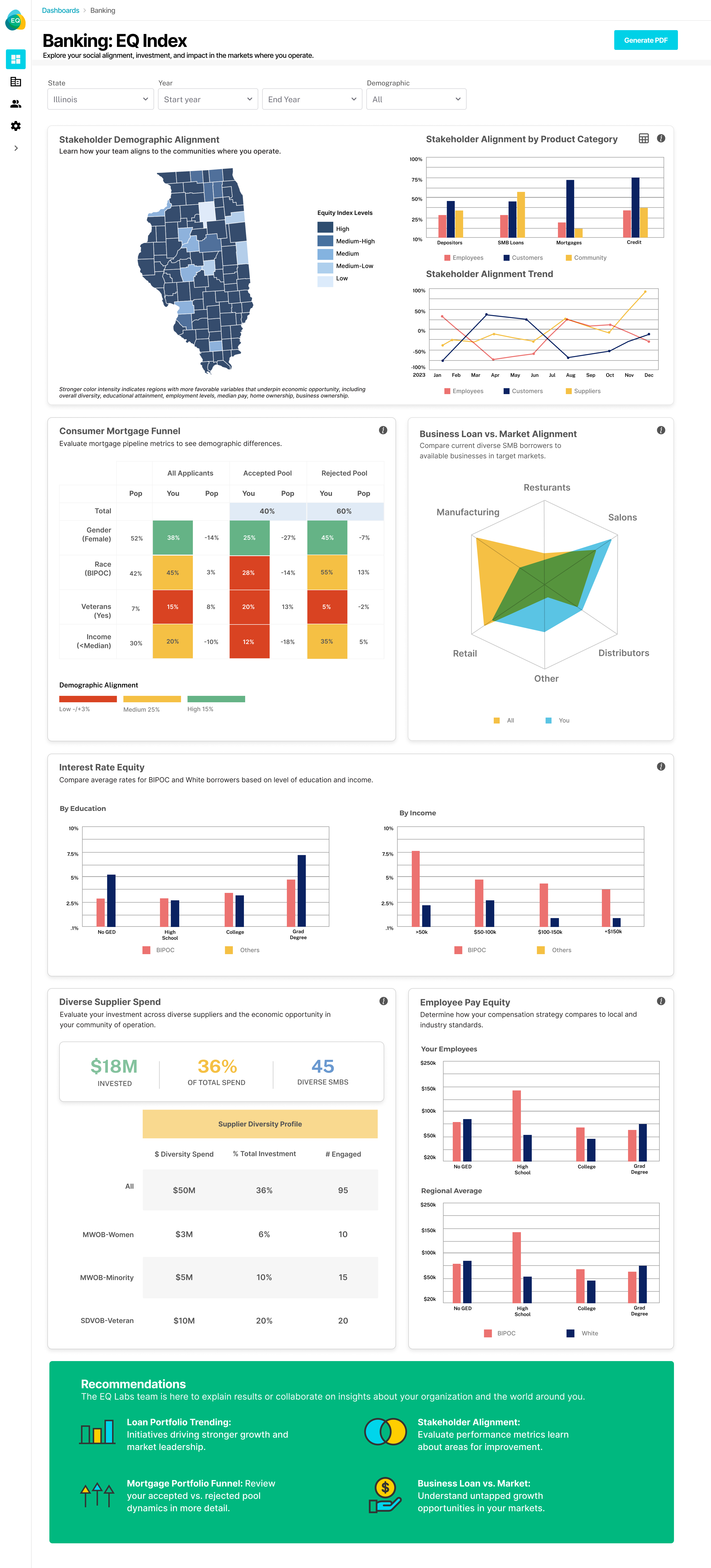

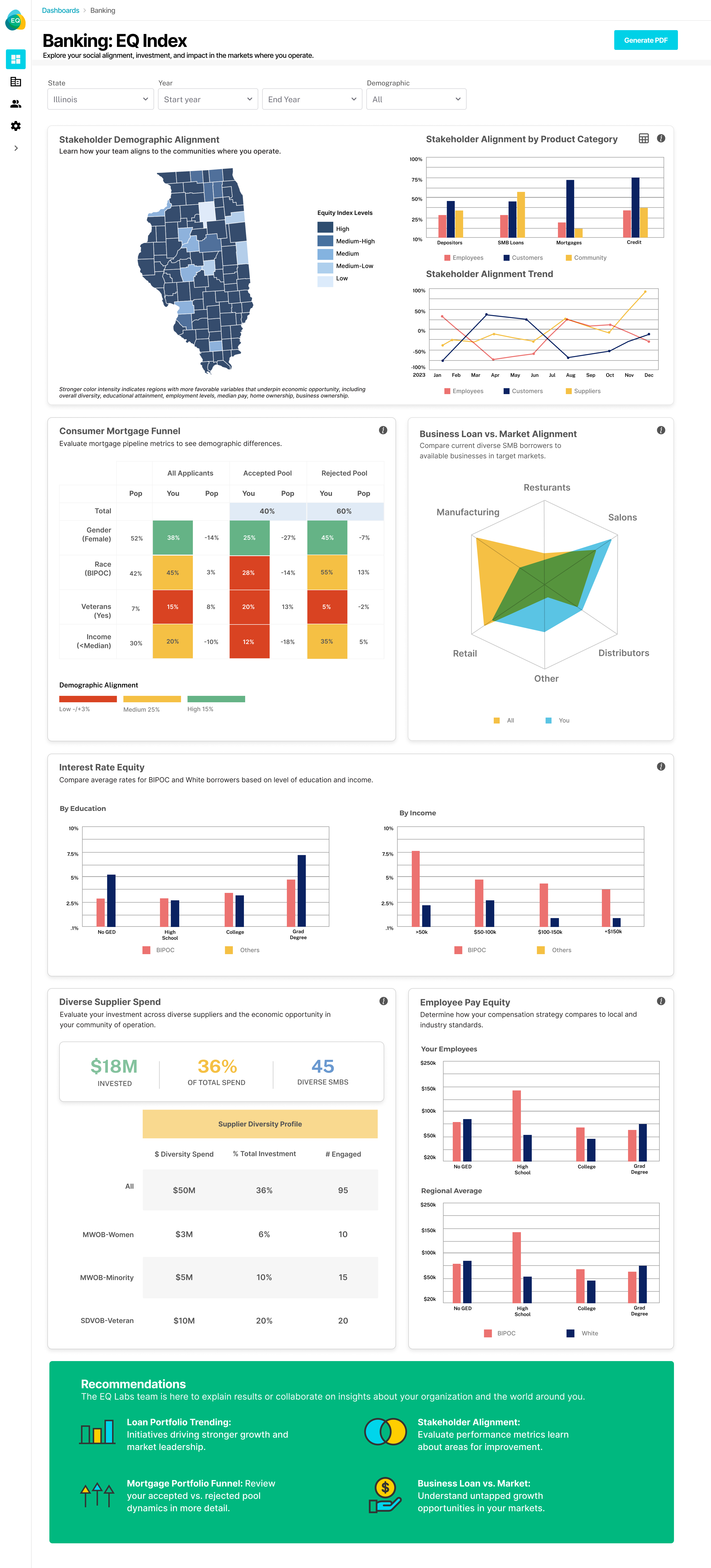

Compare the demographic makeup of your employees to the depositors in your area of operations.

Segment your demographic makeup by stakeholder group (Employees / Suppliers / Customers / Community) for each product category.

Baseline the progress of your EQ S-factor over time relative to your strategic imperatives.

Evaluate mortgage portfolio funnel metrics–all applicants and accepted/rejected rates vs. the community.

Unpack how your business loan portfolio aligns with your local ecosystem of minority & women-owned businesses broken down by industry.

Learn how EQ can create opportunities for your business.

Understand where bias exists in your lending process and how to take action and remain aligned with your strategic objectives.

Be intentional about your procurement strategy and achieve a more cost-effective and resilient supply chain ecosystem.

Prioritize the diversity of your retail banking teams and better understand how pay equity across demographic groups can impact talent acquisition and retention.

Optimize growth while measuring impact and automating compliance

Access rich data

Rich socioeconomic data in a secure, organized, easy-to-navigate platform.

Save time and money

Dynamic insights at a fraction of the cost for what it would take to build a team or commission a report.

Identify growth opportunities

Market Opportunity

The US economy stands to gain

$8 Trillion

by 2050 simply by closing the racial equity gap.

Equity Quotient

AS MUCH AS +20%