One of the biggest challenges facing ESG

The call for corporate accountability and transparency has intensified from all major stakeholders coming out of the COVID-19 pandemic, including investors, regulators, consumers, employees, and communities. Business leaders are saying that firms now require the community’s permission to operate.

Environmental, Social, and Governance (ESG) reporting has become the de facto standard for helping stakeholders understand a company’s impact on the world and its risks based on internal and external factors, along with its financial performance. However, that “standard” has faced significant controversy for many reasons, mostly due to ESG’s 600+ competing scoring models.

One of the biggest challenges facing ESG today is that the S factor lacks a concrete, data-driven measurement platform to calculate impact. Luckily, combining rich data from organizational stakeholders with advanced technologies makes it possible to measure the S in ESG in objective, concrete ways.

What are the inputs needed to measure the S in ESG?

The S in ESG addresses Social impact, and a company’s associated risk due to its actions involving employees, customers, and the communities where it operates. Each company is unique based on its geography, industry, size, business model and other factors, so the metrics it chooses to disclose should consider what industry and regional peers are reporting. This helps stakeholders comparing results between companies understand what “good” looks like and how companies, communities, and industries are evolving over time.

The pillars of the S in ESG include:

- Diversity, equity, and inclusion (DEI): While investors care about a board and executive team’s diversity, they are increasingly interested in understanding the company’s broader DEI initiatives and impact across all stakeholders in the organization. DEI programs can range from hiring and promotional practices, to investment in building diverse talent pipelines, to procurement practices that yield stronger representation from minority and women-owned (MWOB) and/or veteran- and disabled-owned businesses (SDVOB). It can also include an evaluation of culture-building and engagement initiatives with the goal of understanding retention and productivity, such as education and apprenticeship programs that help employees feel invested while creating a more effective workforce. DEI also encompasses the customer community, particularly for businesses that engage directly with consumers, such as banks, hospitality firms, healthcare institutions, and retailers.

- Fair labor standards: The standards a company has in place to ensure the health, safety, and broader viability of its employees are a core component of the S in ESG. Labor standards go beyond current state impact metrics to examine more predictive factors. A company’s labor standards provide important context for understanding an organization’s underlying infrastructure, or its ability to sustain long-term performance and develop for the future.

- Supplier relations: Healthy supplier relations are foundational to strong corporate performance and long-term success. Each organization’s supplier ecosystem includes an interconnected mix of firms of all sizes from a range of industries. Furthermore, while some suppliers might be close to home, others are global and operating with extended entities around the globe. While the S historically focused mostly on employees, investors and other stakeholders are increasingly interested in understanding the diversity, efficacy, and resilience of a firm’s supplier portfolio. One driver of this evolution is the material economic impact a company has on its surrounding communities and broader markets based on its procurement strategies. Being more intentional about inviting diverse suppliers into bidding processes can yield a material, positive outcome in terms of overcoming the racial wealth gap.

- Responsible sourcing and conflict materials: Companies are also being held accountable for establishing a responsible sourcing process as part of their overall ESG strategy. Many elements of responsible sourcing are well-established, rely on existing frameworks, and already require regulatory disclosures. For example, the conflict minerals rule, which has been in place since 2012, follows the Organization for Economic Cooperation and Development framework, relies on an industry standard template for data sharing, and requires an annual Securities and Exchange Commission (SEC) filing. As this compliance process transcends both the E and S, it can be incorporated into broader ESG reporting and also serve as a guide for organizations planning for new obligations regarding anti-human trafficking, carbon emissions and other areas.

- Product and consumer safety: For manufacturers and producers of goods, managing product safety risks is key to the S in ESG. Tracking the entire process, from the raw materials sourced through finished goods, enables companies to manage risk more effectively and intervene when one of the puzzle pieces has been compromised. Beyond achieving stronger clarity and accountability, bolstering the safety standards at each phase of the process can help drive sustainability and growth while minimizing the risks and costs associated with them, including reputational damage.

- Corporate social responsibility (CSR): CSR has been around for decades as companies aimed to improve their community relations in order to benefit from customer and employee loyalty and more smooth approval processes with state and local entities. Historically, CSR has been treated as a set of activities and investments that a company is obligated to to pursue, but it mostly falls outside of core business operations. For some companies, it has increasingly been seen as a powerful marketing tool and integrated into brand building campaigns that can be tracked and measured, but most companies have struggled to fully understand the concrete ROI on their CSR-related activities. These activities can include contributions to local not-for-profit organizations, allowing employees to take time off of work to volunteer in their local communities, or forging partnerships with local organizations to provide a mix of financial and in-kind support. New technologies are making it possible to gather relevant inputs, understand investment, and track resulting impact along with DEI metrics to gain a more comprehensive understanding of the S in ESG posture.

- Technical infrastructure–operational and intellectual property protection: As businesses become increasingly digital and interconnected, ESG has begun to include the analysis of a company’s technology infrastructure in order to understand its risk and opportunity. The two key components of technology infrastructure include operational resilience and intellectual property protection. Operational resilience is a company’s to avoid technical disruption that could materially compromise ongoing operations, or engagement with employees, suppliers, customers, or the broader marketplace. Meanwhile, intellectual property protection includes a company’s ability to protect its core data assets, which might include customer records and other data bound by privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA), European Global Data Protection Regulation (GDPR) or California Consumer Protection Act (CCPA).

What tools are companies using to measure the S in ESG?

Included here are a few examples of how companies are measuring and managing ESG to mitigate risk and achieve compliance imperatives:

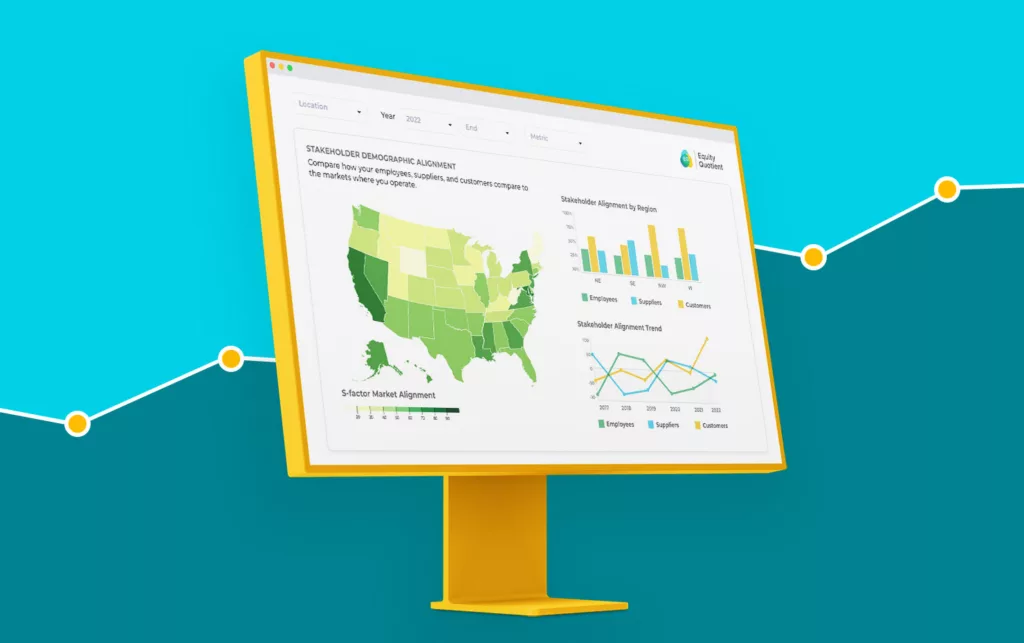

- ESG data dashboards: ESG data is becoming increasingly available thanks to the rise of ESG reporting standards and the development of ESG data analytics tools. Dashboards are a great way to track relevant ESG data because they provide a clear and concise overview of a company’s ESG performance and impact. ESG-focused data can be used to track a wide range of factors, including a company’s greenhouse gas emissions, water usage, employee satisfaction and diversity. By tracking ESG data, investors can gain a better understanding of a company’s ability to manage these important issues. There are many different aspects of ESG that can be tracked on a dashboard. For example, a company’s carbon footprint is an important environmental factor. Social factors include things like employee satisfaction and diversity. Governance factors include things like board composition and executive compensation.

- ESG social media tracking and analytics: Social media is an important platform for conveying ESG information to stakeholders. Tracking and analyzing ESG social media activity can help companies and organizations understand how they are perceived by the public, identify key ESG issues and track progress over time. ESG social media tracking and analytics can also help businesses make better-informed decisions about where to allocate resources to achieve the greatest impact to manage their brands and proactively mitigate the risk of reputational damage.

- ESG data analytics and modeling: ESG data analytics is the process of collecting, storing and analyzing data related to a company’s ESG performance. ESG data is becoming increasingly important for investors and companies alike. ESG data can help investors assess a company’s performance in areas like environmental sustainability, employee relations and corporate governance. This data can come from a variety of sources, including financial reports, public disclosures, media coverage and third-party ratings. ESG data analytics can be used to track a company’s progress on ESG goals, identify areas of improvement and compare ESG performance against peers. ESG data analytics can also be used to generate ESG metrics, which are numerical values that represent a company’s ESG performance.

Achieving a data-driven standard for the S in ESG

While ESG measurement has become increasingly robust since the start of the Pandemic, particularly across the E and G pieces of the equation, the S continues to lack a standard evaluation approach despite its 50% weighting in leading scoring models such as Morningstar’s MSCI. Social impact can appear to be inevitably subjective and more soft, yet advanced diversity data and new AI-powered technologies now make it possible to achieve a more advanced, objective approach at scale.

Ideally, ESG’s S measurement would also include the five key success ingredients that have been achieved for E, including:

- Quantitative: The old adage about managing what you measure has been proven time and again, so having an objective, data-driven, and quantitative way to evaluate emissions has been critical.

- Benchmarking: Meanwhile, applying that measurable standard at scale across firms enables benchmarking, which helps both companies and stakeholders understand where each company stands, or how it’s progressing on the journey to net zero, compared to peers.

- Trending: Tracking key metrics compared to peers dynamically makes it possible to keep the challenge and opportunity front and center over time as things evolve–both within the organization and the world around it–and adjust initiatives as needed.

- Configurable: To be relevant and impactful, the model must recognize that every company is unique based on its geography, industry, size, business model, and other relevant factors in setting goals, benchmarking against peers, and providing recommended actions.

- Actionable: Last but not least is that these models tee up recommended actions that are both ambitious and achievable, aligning cross-functional teams around setting strategic goals and continuously collaborating to make progress and remain accountable to each other and their external stakeholders.

Achieving a data-driven standard for the S in ESG

As we continue to face the challenges of a post-Pandemic global economy, it’s more important than ever to focus on these foundational ESG S stakeholder pillars — employees, suppliers, customers, and community. Applying a data-driven approach to understanding the current state and charting a future state to growth can help cut through the noise in a complex global competitive landscape. An exciting opportunity exists to capitalize on advanced technologies and gain unprecedented insights that can guide your organization toward achieving the best possible version of itself throughout the entire value chain.

Meet Equity Quotient

We increase access to socioeconomic data to shape a thriving economy inclusive of the people that drive it.

Humanizing Data. Catalyzing Growth.

Equity Quotient is an AI-powered stakeholder intelligence platform that aggregates a wide range of socioeconomic data into easy-to-use dashboards to help leaders can make more informed decisions to meet both regulatory and market-driven pressure.

We are charting the future of inclusive AI with our creation of a proprietary data platform, ML-powered analytic model, and use of other advanced AI technologies to create a large language model and make outputs more consumable with natural language processing and interactive visualizations.

With Equity Quotient, executives across sectors better understand their workforce, suppliers, customers, and community to measure impact, automate compliance, and optimize growth.