Introducing

The EQ Opportunity Dashboard for the Housing Market & Mortgage Credit

Introduction

Unpacking Home Ownership

In 2019, the Black homeownership rate was about as low as in the 1960s, when private race-based discrimination was legal.4

Step 1: Explore Your World

Step 2: Chart a Strategy

Step 3: Execute for Success

Step 01

Explore Your World

Gain a fresh understanding the challenge and opportunity

In the BIPOC community, the home ownership opportunity is significantly higher as only 48% of the population is participating in home ownership at the national level.7

Step 01

Chart a Strategy

Capitalize on the power of growth insights through data and analytics

Companies looking to uncover opportunities for growth can start with rich data and analytics that tell a story about each market where they’re currently operating or new frontiers that they’re interested in exploring. Historically, this rich data on consumers, housing, and mortgage financing has been stored in disparate systems and required advanced skills to engineer a cohesive picture of the opportunity by region versus your organization’s current state business. New AI-based technologies and advanced data platforms make it possible and cost effective for any company, large or small, to explore the world where they operate, understand their current state compared to what’s available, and discover untapped go-to-market plays they can map into their strategic plan to achieve both top and bottom-line financial objectives.

On the demand side of the equation, US Census data intersected with rich private data sources on consumers and businesses can provide a valuable starting point for understanding where the most significant opportunity areas exist. Looking at population metrics by race along with metrics such as average income, business ownership, educational attainment, and home ownership levels surfaces insights into where a critical mass of eligible borrowers exist.

This data-driven view of markets throughout the US can help real estate development and consumer banking leadership teams determine where opportunities exist for growth within their existing markets or in potential expansion regions.

Step 01

Execute for Success

Align your organization to take concrete action and seize the opportunity

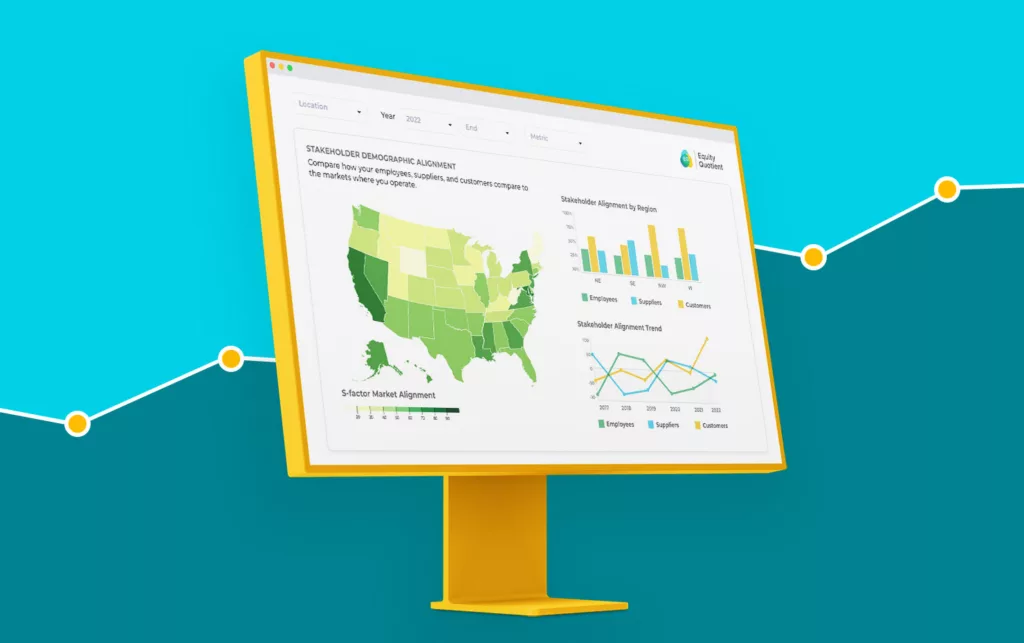

One compelling dynamic that organizations should consider as they devise initiatives to drive growth is the power of Demographic Alignment.

By considering the difference in home ownership levels and other key metrics across the mortgage funnel, we can start to understand the source of the challenge and opportunity that exists for stakeholders on both the supply and demand side of the equation.

Meet Equity Quotient

We increase access to socioeconomic data to shape a thriving economy inclusive of the people that drive it.

Humanizing Data. Catalyzing Growth.

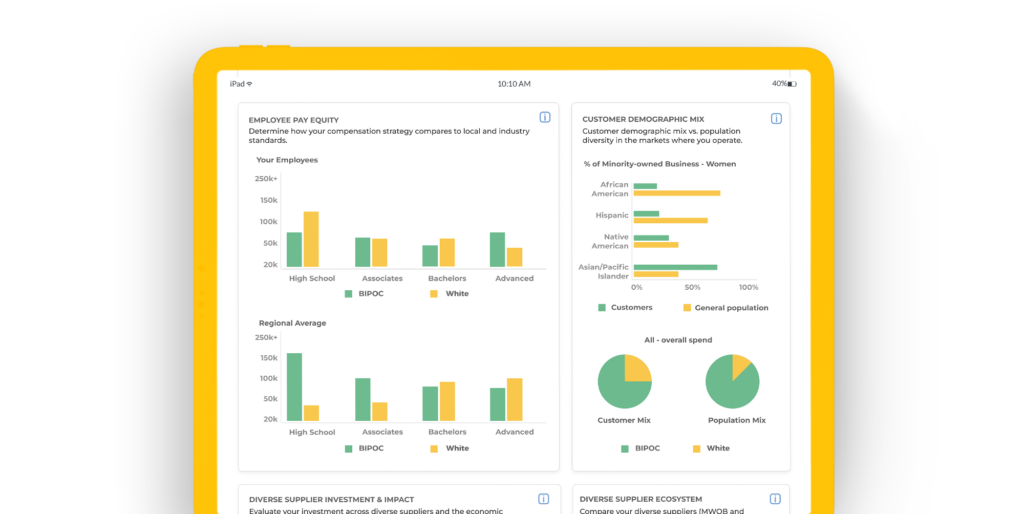

Equity Quotient is an AI-powered stakeholder intelligence platform that aggregates a wide range of socioeconomic data into easy-to-use dashboards to help leaders can make more informed decisions to meet both regulatory and market-driven pressure.

We are charting the future of inclusive AI with our creation of a proprietary data platform, ML-powered analytic model, and use of other advanced AI technologies to create a large language model and make outputs more consumable with natural language processing and interactive visualizations.

With Equity Quotient, executives across sectors better understand their workforce, suppliers, customers, and community to measure impact, automate compliance, and optimize growth.

Endnotes:

- Homeownership Remains Strongly Linked to Wealth-Building,” Odeta Kushi, November 5, 2020, First American Blog

- New York Times

- U.S. Department of Treasury

- NPR

- Eye on Housing, Robert Dietz, NAHB, January 27, 2022

- Total home sales in the U.S. 2011-2021 with forecast for 2023, statista, Statista Research Departner, July 27, 2022

- Source: US Census, EQ Dashboard Analytics