What is the S in ESG?

What is the S in ESG?

Key Highlights:

- Companies that prioritize the S in ESG are more likely to succeed financially.

- Measuring the S in ESG is hard and there is currently no widely accepted definition.

- 85% of institutional investors incorporate ESG factors into their decision-making.

- Firms with female CFOs are more profitable compared to the market average.

- The US economy stands to gain $8 trillion by 2050 simply by closing the racial equity gap.

Table of Contents:

The S in ESG

Stakeholders

Meet Equity Quotient

Section ONe

The S in ESG

The S in ESG

Understanding the ESG imperative

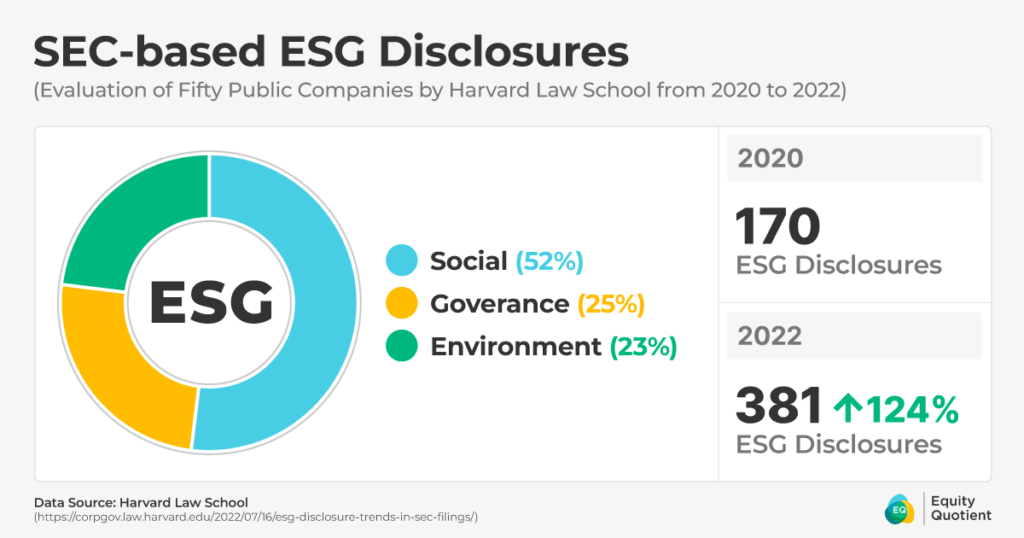

Studies show a strong connection between financial performance and positive ESG posture, demonstrating companies that adhere to environmental, social and governance standards tend to outperform the S&P 500.

When companies prioritize the S in ESG, they are more likely to succeed financially; when they fail, they suffer financially. Investors are more likely to invest in companies with a clear workforce structure to minimize labor strikes and low retention rates or companies whose products don’t pose safety risks. Companies must also consider how social context affects their market size or how their market may change due to social change (S&P Global).

The S in ESG

What is the S in ESG?

The S in ESG represents the social component — in other words, the dynamic measurement of an organization’s people, policies and actions as it affects the community, society and world at large. The lack of a clear, objective and measurable standard for the S in ESG leads to confusion, calling into question the efficacy of ESG scores and ESG frameworks more broadly.

S in ESG data is complex, disparate and expensive for organizations to collect and analyze on their own.

When it comes to the S in ESG, company leaders struggle with an intractable challenge of trying to hit a target that hasn’t been defined. So how can we evolve the S in ESG from subjective to substantive? At a high level, the S in ESG seeks to determine the quality or health of the relationship between a company and its stakeholders, with the ultimate goal of determining how these relationships could influence a company’s financial performance and impact the world in which it operates.

The S in ESG comprises diversity metrics and social factors that influence a company’s financial performance.

There are four main subcategories of social issues:

- Workforce: Companies that have a sound workforce structure that minimizes labor disputes, achieves strong retention rates, and avoids reputational damage realize stronger productivity, innovation and growth.

- Suppliers: Companies that are thoughtful about product safety, the implications of geopolitical conflict, healthy supplier diversity and other risks that might destabilize their supply chains realize stronger, more predictable performance and lower costs over the longer term.

- Customers: Companies that effectively consider how external market dynamics and social change impact their demand dynamics better adapt to changing conditions and outperform peers.

- Surrounding community: Companies that build strong relationships with their surrounding communities build sustainable markets for talent, customers and suppliers while promoting a virtuous circle that helps drive positive business outcomes related to state and local approvals, economic development incentives and other reputational benefits.

Section Two

Stakeholders

Stakeholders

The importance of key stakeholders for ESG

- Employees: Workforce strategy is key to a company’s success, particularly over the long term. Organizations must be able to attract relevant talent, foster a culture that promotes productivity and achieve strong retention to compete and grow. Investors evaluate companies based on these metrics because they have been proven to support growth while minimizing unnecessary cost and risk. Companies play an important role in the economy by providing a livelihood for workers. How intentional they are about who they hire and how they treat their workers can have a significant impact on the communities in which organizations operate. Furthermore, their focus on pay equity, providing a living wage and supporting employees on their path to building wealth through saving and home ownership are all important considerations in evaluating impact and growth opportunities for both companies and their stakeholders.

- Suppliers: Diverse supply chains are foundational to healthy business operations. Companies have an opportunity to impact the broader economic ecosystem by proactively pursuing a thoughtful procurement approach that invites diverse suppliers into the mix. Additionally, many larger companies with strong economic power are realizing the importance of investing in both workforce and supplier development in the communities where they operate to ensure a robust, diverse pipeline of direct and third-party talent. The lack of available skills to support the full supply chain lifecycle and a healthy competitive bidding process is a problem for individual firms and the economy more broadly. A significant opportunity exists to help companies see the supplier relationships more clearly, both from a current state standpoint as well as their role in fostering a stronger ecosystem over the long term.

- Customers: Customer relationships are the lifeblood of any company, regardless of whether the business model is business-to-business (B2B) or business-to-consumer (B2C). Understanding those relationships based on demographics all throughout the funnel, or customer lifecycle, can provide important insights into where risk and opportunity exist. For example, a consumer bank might gain material insights by evaluating the mix of its customer portfolio and how it compares to the communities in which it operates — from its depositors, to its loan applications, interest rate pricing, accept/reject rates, appraisal values and defaults. Meanwhile, a real estate development organization investing in opportunity zones would benefit from understanding the demographics and economic dynamics of the communities in which it’s investing, evaluating its impact investing goals and tracking them over time. This clearer view helps to focus new investment opportunities while also honing execution strategies to maximize ROI and impact.

- Community: More than ever, the broader community of interested stakeholders are calling for greater transparency from companies regarding their ESG posture, particularly their environmental and social impact. With increased disclosure rules and stakeholders who care about whether a company is doing good and doing well, all executives must now determine how their business practices will be perceived by stakeholders. From workforce diversity and equal pay, to healthy supply chain practices, to community engagement and products with a purpose, all companies need to connect profit with purpose. Without a healthy community thriving and growing around them, there is no future for the company or its shareholders.

Section Three

Growth. Value. Impact.

Growth. Value. Impact.

How the S in ESG can drive growth, value and impact

While some ESG pressure is generated by governmental demands, the private sector is also keenly focused on understanding an organization’s ESG posture and the factors that underpin it. There are two key reasons behind that increased attention:

- Market pressure: Individual investors, consumers and employees care deeply about impact and sustainability, are watching closely and have a powerful voice across social media and other communication outlets. ESG investing now comprises nearly 33% of assets in both private and public sectors globally and 85% of institutional investors incorporate ESG factors into their decision-making, according to Bloomberg.

- Financial success: Companies that are proactively intentional about ESG-related imperatives and make them core to their operating models dramatically outperform their peers on every major KPI over time. A strong ESG posture is the new “alpha,” for the investor community, or the key differentiating factor for a company that powers a company to compete more effectively and outperform its peers to deliver above-average returns over time.

Shifting leadership’s approach to ESG from a superficial, check-the-box obligation to a strategic initiative that can drive competitive advantage opens the opportunity to achieve financial success and paves a path to growth for everyone.

Section Four

Meet Equity Quotient

Equity Quotient and the S in ESG

Our goal is to standardize the S in ESG in a way that any organization, regardless of size and industry, can get a clear snapshot of themselves, their community, and the opportunity they have to take positive action and manage risk with our data.

More clarity for businesses, their stakeholders and operations in the context of the world in which they operate paves the way for more inclusive decisions that ultimately create a win-win for everyone.

ESG is becoming increasingly relevant, and in our current environment, when the social factor is better understood and widely embraced, companies advance racial, gender, and socioeconomic equity and ensure their long-term sustainability and financial success.

Shifting the focus from a box to check to an opportunity to create social impact and achieve greater financial success promises a more optimistic and responsible corporate environment.

Equity Quotient