We’re charting the future of Health Equity with HFMA Read the Press Release

Business Services

Explore our Case Studies:

Business Services

Explore our Case Studies:

ESG Scoring Model (1 of 600+)

Scenario

Leading ESG model lacks a quantitative standard for evaluating the S factor similar to emissions measurement for E

Client Challenge

A leading ESG scoring model is under fire for the lack of quantitative measurement that underpin its framework. While emissions measurement platforms have helped add objective rigor and efficacy to the E that can be benchmarked across peers and tracked over time, the S is based on high level subjective inputs that preclude the same level of risk analysis (i.e., board/exec team diversity, social media reputational scraping, employee survey).

EQ Solution

Anchored in the proven concept of Demographic Alignment, Equity Quotient’s rich data and AI-powered analytics platform makes it possible to quantitatively measure S risk across all relevant stakeholders– employees, suppliers, customers, and communities. Driving quantitative rigor can help scoring models maintain relevance and annual revenues of ~$2B growing at >30% YoY.

A dashboard that optimizes decision making

Track to a standard

Bolster efficacy of scoring model by achieving a quantitative approach to measuring ESG S comparable to ESG’s E emissions measurement platforms.

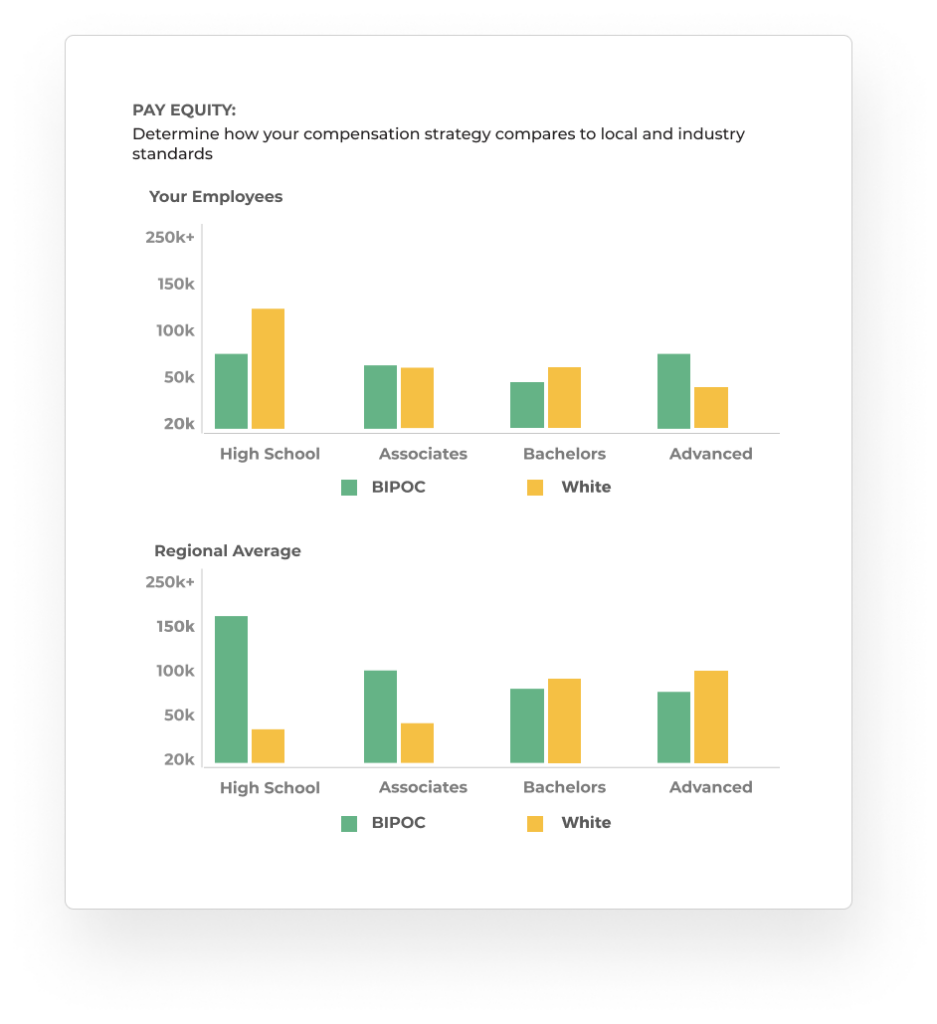

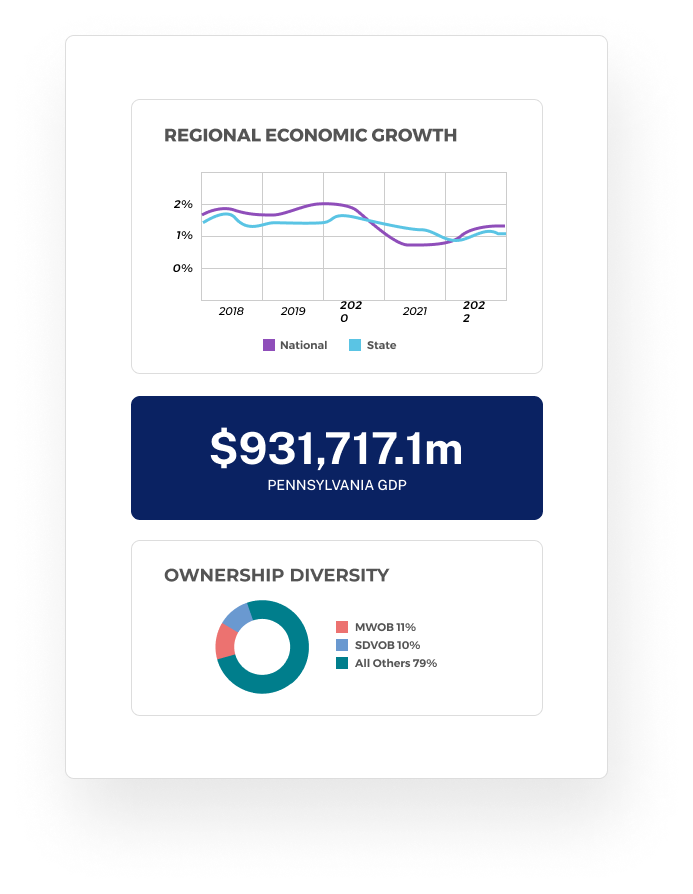

Manage S in ESG data

Automatically generate rich data on S KPIs such as pay equity and median income by geo/ industry/ role along with inputs on reputational analytics and stakeholder survey feedback.

Benchmark & track

Compare companies to more relevant benchmarks based on geo/ industry/ size/ business model and other relevant factors over time to more accurately understand risk.

Turn insights into action and impact!

Automate S in ESG data

to achieve stronger efficacy and efficiency in models.

Hone peer groups

to be more relevant based on geo/ industry and other relevant factors.

Differentiate score

based on robust, actionable measurement that’s relevant to investors and firms.