Part One - The Diversity Data Imperative:

How to Go From Subjective to Substantive.

Diversity has become a 21st century workplace buzzword — but organizations that only look at diversity as a trend or a compliance mandate are missing out on the advantage, opportunity, and value that diverse organizations achieve.

Part One - The Diversity Data Imperative.

How to Go From Subjective to Substantive.

Diversity has become a 21st century workplace buzzword — but organizations that only look at diversity as a trend or a compliance mandate are missing out on the advantage, opportunity, and value that diverse organizations achieve.

Key Highlights:

- Doing diversity well is foundational to business success.

- Historically, businesses have struggled to understand what “good” looks like for their organization from a diversity perspective due to the lack of an objective, relevant, and quantitative framework.

- Rich diversity data from multiple sources and advanced AI-powered analytics make it possible for companies to now measure and manage diversity across all major stakeholders portfolios.

- Companies that embrace the diversity imperative and align around a set of goals to achieve them stand to benefit on every major external and internal performance KPI.

Table of Contents:

Diversity

diversity data

Meet Equity Quotient

Section ONe

Diversity in Business

Now is the time to change the approach to ESG’s S and the DEI imperative that help companies evolve from subjective to substantive.

diversity

Why is diversity important in business?

In a November 3, 2022 episode of The New York Times podcast The Daily, Adam Liptak, a correspondent covering the Supreme Court for The New York Times, talked about the importance of quantifying the impact of diversity initiatives and the implications it could have for the future of affirmative action. “Several justices start to bring up the point that if you can’t define, quantify, and measure your diversity, how do you know you’ve really achieved it?” He asks. “How do you know when you’re done?”

Diversity has become a 21st century workplace buzzword — but organizations that only look at diversity as a trend or a compliance mandate are missing out on the advantage, opportunity, and value that diverse organizations achieve. Data across multiple studies indicate companies that prioritize diversity and proactively measure diversity data are more productive, competitive, and successful, outperforming peers on every major internal and external KPI .

Data across multiple studies indicate companies that prioritize diversity and proactively measure diversity data are more productive, competitive, and successful, outperforming peers on every major internal and external KPI .

Beyond data that demonstrates the compelling new ROI (Return on Inclusion) for businesses that make diversity core to their strategy and operations, measuring diversity data is an important component of the ESG imperative.

Stock price impact

- 5.79% higher

LT Market Performance

- 3.5% 4-factor alpha

ESG (Environmental, Social and Governance) is a framework intended to help stakeholders understand, measure, and manage an organization’s long-term risks and opportunities. The ESG model is now firmly in place on both the investor and corporate side of the equation, with over one-third of assets under management in both public markets and private equity portfolios tagged as ESG-compliant or impact-focused. The impact of ESG on a company’s perceived long-term value and viability is significant–those with positive changes in their ESG scores realize nearly a 4% increase in stock price while a negative move in the score leads to nearly a 2% decline in market capitalization–a difference of nearly 6% for those doing ESG well versus those that are falling short . Furthermore, a company’s ESG posture also materially impacts a company’s cost of capital, as firms with more positive ratings enjoy rates 50 basis points lower on average compared to peers.

Although ESG is largely associated with Environmental Impact and emissions measurement, the Social Impact component of ESG evaluations is weighted at over 50% in leading scoring models, such as Morningstar’s MSCI. The challenge with the current approach to the S in ESG is that the model lacks a quantitative, objective measurement approach analogous to what emissions scoring models provide for Environmental Impact. Current information cited in ESG reports related to Social Impact are cursory and subjective at best:

- Leadership Diversity: High level statistics limited to the board and executive team.

- DEI Roles & Programs: Whether a DEI leader has been named and programs such as employee resource groups (ERGs) have been established.

- Employee Surveys: Credit is given where an employee survey is conducted, versus data on the results.

- Cybersecurity Posture: Robustness of technology in place to protect employee and customer PII data.

- Media Reputation: How stakeholders (employees, suppliers, customers, and the market more broadly) are talking about the company in public outlets, including social and traditional media.

The lack of impact-focused data and actionable insights in current approaches is a significant concern for all stakeholders–boards, executives, and the investor community. Heads of ESG for some of the world’s largest investment firms have been heard repeatedly saying, “We now have the E well in hand. It’s the S that’s keeping me awake at night.” Despite the importance of the S imperative to ESG ratings and our society and economy more broadly, we continue to lack definition around how companies should endeavor to hit a target that has not been defined. ESG’s S is effectively a standard that’s not standardized. Now is the time to change that with an approach to ESG’s S and the DEI imperative that help companies evolve from subjective to substantive.

Let’s explore how we might make that ambitious goal achievable.

Diversity

How should we define diversity?

Diversity refers to the individual characteristics people have that make them unique. Though diversity has traditionally been boiled down to race and ethnicity, it comprises many factors that encompass the range of human differences, including but not limited to race, ethnicity, gender, gender identity, sexual orientation, age, socioeconomic status, physical ability or attributes, religious or ethical values system, national origin, and political beliefs.

Diversity refers to the individual characteristics people have that make them unique.

The powerful impact of diversity is evident in many contexts in our world. In investment portfolio management, which is focused on maximizing risk and minimizing the financial return of a given allocation of resources or personal wealth, diversification is core to realizing the best possible outcomes given an investor’s unique situation and objectives. The concept of diversity is also fundamental to business practices such as cybersecurity strategy to maximize robustness and minimize risk in protecting digital assets. Lastly, all of us learned about the importance that diversity plays in nature, and how critical that balance is to environmental health and growth.

Those same diversity dynamics illustrated for investing, cybersecurity, and nature also play out with people portfolios in organizations, including employees, suppliers and customers. Given the strong business case for diversity, all organizations stand to gain considerable benefits by measuring diversity data and pursuing initiatives that optimize their diversity profile given their unique situation–i.e., their geography, industry, size, business objectives, and other relevant factors.

Achieving the robust new ROI or return on inclusion noted earlier requires organizations to be data-driven, proactive, and thoughtful about their diversity strategy across key people portfolios. Studies tracking ESG scores and financial performance outcomes have also found that it’s not enough to “talk the talk.” Getting this right also requires an approach that makes diversity a strategic imperative that’s core to all functions and a seamless component of everyday operations. Finally, it also includes a more concrete, measurable approach underpinned by data-driven rigor that provides guidance on actionable initiatives and enables true benchmarking, trending, and tracking over time.

Section Two

Diversity Data

So how should leaders get started on the journey to maximizing their Return on Diversity (RoD)?

diversity data

What's the best way to get started?

So how should leaders get started on the journey to maximizing their Return on Diversity (RoD)? We recommend three key ingredients to kick off your exploration:

- Ask the right questions

A sound diversity strategy that will yield compelling positive results over the long-term considers the full continuum of stakeholders, including employees, suppliers, and customers. Equity Quotient’s Get Started Questions Guide provides an opportunity to begin exploring how you and your extended team should think about each of these stakeholder groups–compared to each other, your surrounding community(ies), and versus your peers or competitors. See a list of example questions here, sorted by role and stakeholder. - Explore Equity Quotient’s Data & Insights Platform

Capitalize on the value of diversity data to understand opportunity and drive growth made available through the EQ Opportunity Index Dashboards. These provide a quick, easy way for corporate leaders to begin understanding the world in which you operate, including the overall diversity of your surrounding communities and key socioeconomic metrics such as educational attainment, employment levels, pay equity, home ownership, and the supplier or business ownership landscape. Learn more here about the EQ Opportunity Index and how to frame potential starting points ranging from Housing Market, Consumer Credit, General Population, and more. - Establish From→To Goals & KPIs for Dynamic Performance Tracking

Once you gain a stronger understanding of the current state, both inside and outside of your organization, it’s possible to define end-state objectives. Cross-functional teams are then able to align around these goals and dynamically track their progress over time, adjusting as things change both internally and in their surrounding socioeconomic landscape.

As you embark on your journey, keep in mind that every company is unique based on its geography, industry, number of employees, skills needed, and other relevant factors—optimal diversity that is ambitious yet attainable will look different for each firm. For example, it wouldn’t make sense to compare a large, global public company in the financial services sector based in New York to a privately held mid-market manufacturing firm based in rural Ohio. Much like personal fitness, achieving the right diversity strategy and outcomes for each organization is a relentless journey and pursuit where you never fully arrive and can always improve. As getting fit looks different for each person based on their gender, age, health, and other relevant factors–so does achieving the optimal data-driven diversity strategy and outcomes over time.

Last but not least, be mindful that the strategy should evolve continuously as both your company’s internal dynamics and world around it relentlessly change. It is not something that a company achieves at a moment in time and then moves on to other things. Furthermore, organizations do not accidentally or organically arrive at a diverse workplace. The endeavor requires a proactive operational shift to achieve balanced, diverse stakeholder portfolios that minimize risk and maximize return. Despite the effort and intentionality required, the reward for companies willing to be bold role models and create an inclusive space for all stakeholders pays big dividends.

Meet Equity Quotient

We increase access to socioeconomic data to shape a thriving economy inclusive of the people that drive it.

Humanizing Data. Catalyzing Growth.

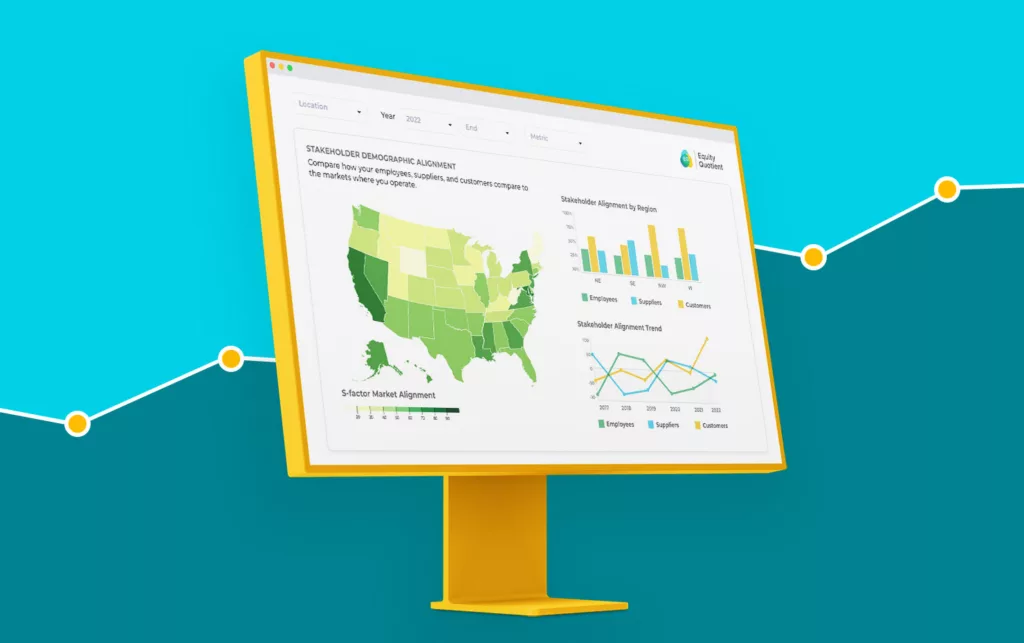

Equity Quotient is an AI-powered stakeholder intelligence platform that aggregates a wide range of socioeconomic data into easy-to-use dashboards to help leaders can make more informed decisions to meet both regulatory and market-driven pressure.

We are charting the future of inclusive AI with our creation of a proprietary data platform, ML-powered analytic model, and use of other advanced AI technologies to create a large language model and make outputs more consumable with natural language processing and interactive visualizations.

With Equity Quotient, executives across sectors better understand their workforce, suppliers, customers, and community to measure impact, automate compliance, and optimize growth.