EQ IQ Series:

The Supplier Diversity Measurement Imperative

Why tracking SBA certifications doesn’t work & how to achieve a standard that’s objective, agile, and actionable

Table of Contents:

FUTURE OF SUPPLIER DIVERSITY

Introduction

Supplier Diversity is the practice of evaluating a company’s procurement investment portfolio to understand how much of the spend is allocated to different types of business owners. Through investments in their suppliers, companies have a significant impact on the economy and the communities that comprise it. Intentional decisions to invite diverse business owners into a corporation’s supplier ecosystem can have a material positive impact on entrepreneurs and workers that have historically been marginalized from full participation in the economy. This engagement can then create a virtuous cycle for diverse communities and make progress in overcoming the widening racial wealth gap.

In recent years, Supplier Diversity programs have undoubtedly become big business. A recent study conducted by Oliver Wyman found that 85% of companies now have dedicated supplier diversity programs and that 59% of companies are reporting publicly on how much they source from diverse suppliers. On average, 10% of company procurement spend is dedicated to diverse suppliers. From an industry perspective, telecommunications and healthcare organizations are leading the way at 10-12%, followed by consumer, manufacturing, and industrial at approximately 8%. Energy and financial services are lower at approximately 6% while tech is the least diverse at 3%-5% on average.

This paper will explore the dynamics catalyzing this growth in dedicated supplier diversity programs. We will also describe the current state approach companies are using to measure and manage their procurement spend and the challenges they are encountering. Finally, we will propose an alternative approach for organizations endeavoring to achieve more automated, operationalized supplier diversity programs that achieve stronger outcomes, from both a financial performance and social impact perspective.

The world has changed dramatically over the past several years and the data and analytics required to understand it have also evolved significantly. As one senior sustainable growth expert who leads a global consulting practice recently said, “Firms now require the community’s permission to operate.” Our stakeholder-led world demands a higher level of transparency and positive impact along with strong investor returns. Dedicated supplier diversity programs are an important component of a strategy seeking to achieve sustainable growth, proactively manage risk, and effectively comply with a myriad of regulatory reporting mandates.

The State of Supplier Diversity

Examining the expansion of programs, current measurement, and the biggest challenges we face.

Why have supplier diversity programs expanded?

The widespread increase in supplier diversity programs is an exciting opportunity for larger companies, diverse businesses, and our economy more broadly. Several factors are driving the increasing demand side of the equation, including:

- Federal Supplier Requirements

A major driver around supplier diversity programs and the data and reporting that has increased related to them is that all firms doing business with the Federal government are required to report on supplier and workforce diversity metrics in extensive detail. This commitment is to increase the percentage of diverse supplier spend from ~10% to 15%+. - Federal Grant Expansion

Beyond the U.S. government’s requirements for federal suppliers, several programs (e.g., Build Back Better, Inflation Reduction Act, Chips and Science Act) have significantly expanded the funding available at state and local levels for clean energy transition, transportation projects, and other infrastructure initiatives. These projects are governed by Justice40 mandates that require a commitment to diverse hiring and procurement spend to achieve positive socioeconomic outcomes in historically disadvantaged communities. - Geopolitical Dynamics & Reshoring

Challenges in Asia, Middle East, and Eastern Europe have led to extensive reshoring initiatives across multiple sectors, such as manufacturing and biotech, among others. According to the Reshoring Initiative 2022 Data Report, a record-breaking 364K jobs were announced, up from 238,000 in 2021, a 53% increase from the 2021 record, bringing the total available to 1.6M. These changes are underpinned by both business dynamics as firms seek to minimize their global supply chain risk and compliance mandates that have expanded the countries that U.S. firms are allowed to engage commercially. - ESG & Socioeconomic Impact Pressure

ESG scoring models and broader stakeholder imperatives around sustainability (environmental and social impact), and greater transparency and concrete KPIs (governance), is driving companies to proactively understand their procurement portfolios and practices. The majority of companies establish goals for increasing diversity in their supplier portfolios and percentage of procurement budget dedicated to diverse firms.

The majority of companies measure their supplier diversity based on ownership, which is typically defined by a firm’s SBA certification status (e.g., Women, Minority, Veteran, and/or Disabled). While SBA certification might appear to be the most efficacious and easy way to understand the diversity and socioeconomic impact of a given procurement portfolio, a deeper look reveals that this approach imposes a significant, intractable problem for companies on both demand and supply sides of the equation.

To better understand the challenge and opportunity, let’s explore current measurement approaches, the goals these programs are trying to achieve, and alternative approaches that might do a better job of providing the information everyone needs to succeed.

How is supplier diversity currently measured?

Nearly all supplier diversity programs are anchored in the Small Business Administration (SBA.gov) certification status, which is typically expressed as MWOB (minority and women owned business) or VSOB (service-disabled veteran-owned business). Women-owned business certification is a distinct certification as minority-owned and veteran-owned are as well. The requirements for achieving one of these three certifications are as follows:

- 51% ownership by the designated “minority” group within a given firm.

- Net worth of the owner must be less than $850,000 in order to qualify.

- Business owner(s) cannot have earned an income of greater than $450,000 on average over the three previous years.

On the surface, these requirements might seem reasonable, but a closer look reveals that the criteria eliminate most businesses that would serve as viable suppliers to corporations. To bring this to life, let’s take an example that hits close to home for our company, Equity Quotient. Our co-founders, Perfecto Sanchez and Christina Van Houten together own the majority of the company and both run it actively full-time. Perfecto is an service-disabled Army Veteran and tenured, big brand marketing leader whose heritage is Jamaican and Puerto Rican (or Black and Hispanic) while Christina is a white woman who’s a long-time technology executive with over 30 years of career experience. On the surface, Perfecto and Christina are the ideal diverse business, or would-be diverse supplier to larger corporations.–i.e., minority-owned, veteran-owned, woman-owned. One would assume that SBA supplier diversity certifications, including WOSB, MOSB and VSOB, should be straightforward and achievable for Equity Quotient to achieve.

However, despite the fact that Equity Quotient is objectively a minority, woman, and veteran-owned business, the business does not qualify for these certifications. Here’s why:

- Ownership %

Equity Quotient has raised seed funding from investors, which has taken our co-founder ownership levels below the 51% threshold. This challenge will exist for most entrepreneurial businesses with the ingredients required to make them viable options for large company supplier diversity programs–i.e., they will have more than one partner and often an outside financial backer, putting them in a position of not meeting the 51% ownership test. - Net Worth

As former executives turned entrepreneurs, both Perfecto and Christina have had seasoned careers and accumulated savings. They have both purchased homes starting in their 20s that have appreciated in value since we’ve owned them as Perfecto just turned 40 and Christina is in her mid-50s. Most business owners that would be mature enough to qualify for a global supplier ecosystem will be like Perfecto and Christina–i.e., have had active careers for over a decade, saved money through their 401K and other investments, and purchased a home. Together, these dynamics will knock out many qualified diverse business owners based on the $850,000 net worth means test.

Moreover, the criteria for MWOB/VSOB certification have made it impossible for a significant portion of minority, women and veteran owned firms that could serve as viable suppliers to larger firms to achieve the relevant certifications. Said differently, the current certification standards are inevitably limiting the pipeline to sole proprietorships without significant investment backing from a third party, or “mom and pop” shops that will mostly not fit the needs of larger corporations with dedicated supplier diversity programs.

The data tells us that this dynamic is causing a significant gap between the number of businesses that are run by diverse founders and those with official certifications. One recent study found that less than half of diverse owned and operated SMBs have a certification despite the significant benefits it provides. Meanwhile, there is a pool of minority-woman–veteran-owned entrepreneurs that are unable to achieve MWOB/VSOB certification, yet could be ideal candidates that could grow the pipeline of diverse businesses, overcome supply chain gaps, and help corporations achieve their procurement objectives. Furthermore, these businesses falling outside of the current SBA certification limitations could help overcome the racial wealth gap through intentional hiring of diverse workers and other initiatives, such as commitments to Fair Chance hiring pledges, creating a compelling halo effect for historically disadvantaged communities and their citizens.

It should also be noted that the SBA diverse business certifications are widely gamed–i.e., many businesses owned and operated by white men are successfully achieving MWOB certifications by putting the business in their spouses name. These businesses then achieve more favorable standing with government contracts and other advantages. The net of this challenge is that businesses legitimately owned and operated by women, minorities, veterans, and/or disabled are eliminated from the program while businesses that do not qualify are achieving certification through workarounds.

What is the biggest challenge for dedicated supplier diversity programs?

From a corporate perspective, the MWOB/VSOB requirements have also created an impossible challenge for dedicated supplier diversity programs. Using these certifications as the foundation for sourcing and accepting diverse businesses into their procurement process has materially limited the pipeline of diverse businesses to those that lack the financial robustness and operational maturity to serve as viable suppliers at scale. As one Fortune 1000 company put it, their process for onboarding suppliers requires 6-9 months to get through the contracting gauntlet, which is typical for most large firms. This process requires significant time and investment from their procurement team, which means they need to be highly confident that the proposed supplier is going to achieve both the financial stability and social impact goals the company must achieve before accepting them into the program. Otherwise, the investment on both sides imposes extensive, unnecessary costs, opportunity cost, and distraction on both sides.

To successfully navigate the funnel and deliver successfully on the other side of it, diverse businesses require a level of operational and financial maturity to scale with larger demand that will come with being part of a large global supply chain. Circling back to the topic of MWOB/VSOB certification, the vast majority of firms capable of achieving the demands of doing business with large procurement teams will not qualify for the programs. Moreover, if companies are anchoring their dedicated supplier diversity programs on MWOB/VSVOB certification–both from a pipeline recruiting and procurement portfolio measurement perspective–they will inevitably face an intractable problem where supply will never meet demand.

The point of this example is that the current certification requirements inevitably constrain the program to include only the smallest family-owned businesses, which would include mostly small retailers, restaurant owners, landscape businesses, individual consultants, or other “mom and pop” shops. While these small local businesses are vital to our economy and play a critical role for all communities, most would not qualify to be viable suppliers for larger firms for multiple reasons. Here’s why:

- Demand/Supply Mismatch

The offerings that these types of businesses provide are largely not within the demands of what bigger companies need. - Financial Position

Their financial standing, by definition, would not be significantly robust to withstand the rigorous requirements that most larger firms require as part of their supplier onboarding process. - Foundation to Scale

The firms providing goods and services that do fall within the purview of what larger corporations need and have the financial position that enables them to scale to the level needed to deliver larger firm orders are mostly owned by more than one party, making the 51% threshold for ownership in any of these categories (women, minority, veteran, disabled) impossible to achieve.

A significant challenge and opportunity exist in this disconnect. The good news is that the demand side of the equation is strong as the vast majority of corporations (85%) now have dedicated supplier diversity programs and concrete metrics they have established to grow the percentage of spend in diverse businesses. The bad news is that the supply side of the equation has some fundamental disconnects that are compromising the ability of those programs to succeed and for emerging diverse businesses to capitalize on the opportunity at hand. The key to overcoming the demand-supply disconnect is to take a fresh look at how programs are being measured and managed and how the full procurement funnel can be measured and managed differently to achieve a win-win-win for corporations, diverse businesses, and their surrounding communities.

The Future of Supplier Diversity

Examining stakeholder goals, how to achieve a robust supplier ecosystem, how to harness data for success, and how to achieve program success.

What are the various stakeholder goals for supplier diversity programs?

Public Interests

Federal, State & Local Government & Communities At-Large

Before we explore more viable solution approaches, let’s examine the goals of various stakeholders involved in supplier diversity programs.

SBA.gov MWOB/VSOB certifications were created to achieve the following objectives:

- Create competitive advantage for disadvantaged business owners

Provide a leg up for entrepreneurs that have lacked access to everything that is needed to establish a viable business and achieve a livelihood that can support their families, build wealth, enable education success for future generations, stable employment, and home ownership. - Catalyze a flywheel effect for disadvantaged communities

Establish a path for wealth creation for owners and their employees, who are also more likely to be from disadvantaged communities, to expand access to and engagement in the economic system and everything that comes with it. - Overcome the racial wealth gap and socioeconomic disparities

Capitalize on the most successful organizations that are continuously making large procurement investments to widen the aperture of which companies are included in the supplier ecosystem, ultimately creating a path to overcome problematic socioeconomic KPIs, such as educational attainment, unemployment, household income, pay equity, health insurance coverage, home ownership, access to credit, and a myriad of public health metrics. - Enable a healthier, more open, and engaged economy capable of sustainable growth

All of these factors together are focused on achieving a stronger economy that continuously creates all of the ingredients needed to achieve growth–educated workers, new job growth, low unemployment, strong entrepreneurialism, dynamic innovation, access to healthcare, available credit, attainable housing, etc.

Private Interests

Corporations with Dedicated Supplier Diversity Programs

From a company standpoint, all firms are trying to remain competitive in order to achieve sustainable, long term performance for their stakeholders. As part of that mandate, they are balancing a myriad of daunting challenges related to driving new growth, managing risks that could compromise investments, and achieving compliance. Supplier diversity programs are endeavoring to address all three of these imperatives:

- Drive New Growth

Every organization’s ecosystem of suppliers plays a critical role in its ability to meet the needs of current customers and its commitments to them while scaling new programs that can drive growth. This inevitable interconnectedness makes procurement strategies and the execution of them mission critical to any firm’s success. Therefore, ensuring strong relationships with sound business partners and building in redundancy are critical to remaining relevant and viable.

- Manage Risks

Due to the inevitable interdependence of firms and their suppliers in achieving growth, organizational leaders must proactively determine where risks might exist and anticipate initiatives needed to mitigate potential disruptions to the business. These initiatives involve complex variables at both a micro and macro level, such as individual supplier risk, evolving geopolitical dynamics, climate impact, and other factors. - Achieve Compliance

Increasingly, all organizations are facing pressure to proactively achieve and report on supplier diversity to convey their commitment and contributions to sustainable growth for themselves and the broader economy. These compliance pressures are coming from both government and markets in the form of regulatory reporting requirements and stakeholder expectations.

Taken together, these three key imperatives have catalyzed the expansion of dedicated supplier diversity programs to the point where the vast majority of firms (89%) now have them in place as part of their core operational approach.

Dedicated supplier diversity programs are now standard operating procedure for nearly all large corporations, yet all firms are struggling to determine the best approach for measuring and managing their programs, both internally among leaders and their cross-functional teams and externally with stakeholders calling for transparency and mandating more onerous reporting requirements. To meet these growing demands, most companies have expanded their procurement systems to expand the data captured in their supplier system of record to include diverse business certifications. From these certifications, firms then derive a profile of their diverse supplier spend as a percentage of the total portfolio.

As cited in the Oliver Wyman article above, these reports indicate that investment in diverse suppliers based on this measurement standard ranges from 3% on the low end to 12% on the high end, and varies widely across industries. All firms are struggling with the following:

- Demonstrating commitment to improving diverse supplier metrics

All organizations are establishing targets for improvement, or long-term goals that take them from their current state of <10% and a future state of ~15% over a 3-5 year horizon. - Limited pipeline of qualified vendors based on current approaches

The current approach anchored in MWOB/VSOB certification is not achieving its objective as noted above and significantly exacerbating the pipeline challenge that many are endeavoring to overcome. - Lack of data needed to invest in diverse suppliers and create positive impact

Data currently being used to understand supplier diversity and related impact is incomplete, inaccurate, and even irrelevant.

A significant opportunity exists to help dedicated supplier diversity programs become a powerful force in our economic growth while also creating positive socio economic impact. To achieve that, these programs require a data driven approach to inform and guide the ecosystem, both on the supply and demand sides of the equation.

What is the best way to achieve a more robust diverse supplier ecosystem in the U.S.?

Public Interests

On one side of the equation, you have 85% of large corporations committed to supplier diversity with programs. On the other side of the equation, you have diverse communities that are eager to engage in the economy and overcome the racial wealth gap. Within those diverse communities, you have hard working diverse entrepreneurs that want to gain access to these large accounts. Historically, they have struggled to break in for a myriad of reasons, particularly based on limited relationships, access to growth capital, and constrained scale.

Key ingredients for success include:

- Dedicated Supplier Diversity Program

With full company/ executive commitment dedicated supplier diversity program that’s operationalized as core to the overall procurement strategy and seen as foundational to sustainable long-term growth. - Healthy Diverse Economic Ecosystem

Surrounding the company where diverse SMBs have the ingredients to thrive–i.e., access to credit, strong workforce, and other required resources. - Economic Development Partners & Impact-focused Financing

Committed to helping diverse suppliers thrive and connecting them with the people, process, technology and other resources to surround them as they evolve, grow, and scale to support Tier 1 enterprises as part of their supplier ecosystem. - Operationalized Data, Analytics & Measurement Platform

The entire continuum of decision making requires rich data and analytics that can be difficult and expensive to achieve with in-house teams. Ideally, stakeholders on both the demand and supply sides of the equation need a detailed understanding of the socioeconomic landscape as they assess the current state of the procurement portfolio, establish goals to increase investment in diverse suppliers, and begin collaborating to execute against these objectives. Beyond rich data and analytics from external sources profiling relevant communities and industries, cross-functional teams also require the ability to integrate internal system data to achieve benchmarking, track progress, and automate reporting to various audiences over time.

Assuming #1 is in place, let’s explore the best way to achieve the other three ingredients. With respect to #2, stakeholders can gain a sense of where they stand by exploring the socioeconomic landscape in the markets where they operate. This exploration would start with evaluating the general population on key metrics, such as overall diversity, educational attainment, unemployment rates, median pay and household income, healthcare coverage, home ownership, and public health metrics more broadly. Furthermore, it would entail evaluating the broader business landscape, including key industry drivers from a GDP standpoint as well as payroll and job contribution. This understanding would also extend into the supplier and workforce landscape to understand the level of diversity across both by industry compared to peer regions.

With respect to #3, economic development firms, or public-private partnerships, have emerged as important advocates for both the demand and supply sides of the equation. These organizations are dedicated to overcoming historical barriers for diverse businesses and bridge the gap between the demand and supply. For example, BEAM Collaborative based in Allegheny County, which includes metropolitan Pittsburgh, is dedicated to sourcing Black-owned and operated companies that have the core ingredients needed to become part of a dedicated supplier diversity program. BEAM then partners with large corporations in the region to understand their goals, particularly related to reshoring, supplier diversity, financial performance, and social impact. As part of that exploration, BEAM and the corporation explore the procurement portfolio at a granular level. This exploration evaluates current spend by industry sector and the contribution to diverse companies as a piece of that investment while evaluating the supply of available diverse suppliers by sector.

BEAM then works closely with a network of diverse businesses across multiple industry sectors, both locally and nationally, to proactively target viable supplier candidates with larger corporation procurement team demands. Building relationships with diverse companies in categories that are needed by the larger corporation(s), BEAM brings supplier candidates into the mix for consideration. BEAM also taps its network of leaders and funders in the Allegheny County business community to engage with targeted diverse businesses to provide everything they need to scale and succeed as a supplier in a large global ecosystem. This support might come in the form of equity investments and/or debt financing for working capital, strong board members and/or advisors, and access to other resources that can help a diverse business grow to a level of size, scale, and maturity needed to meet the demands of a large corporate account and everything that comes with that over time.

Recruiting viable diverse businesses and surrounding them with all of the ingredients needed to bolster their success as a diverse supplier is a critical component of overcoming the demand and supply gap. While BEAM Collaborative’s model is exciting for Allegheny County, other comparable economic development organizations have emerged in other regions, particularly throughout the midwestern and central United States. Chambers of Commerce are taking an active role as well as organizations such as JumpStart, Inc. in Ohio and GNO, Inc. in New Orleans.

Beyond these economic development organizations focused on bridging the gap between the demand and supply sides of the equation, the emergence of impact-focused venture capital funds is a key ingredient to bolstering the availability of diverse companies with the capacity to scale with large corporate contracts. Innovative leadership from funds like Lockstep Ventures, Zeal Capital, Emerson Collective, and others is an exciting change in our economy that has been powering a new generation of black-owned businesses. Meanwhile, traditional banking institutions have become very intentional about supporting diverse businesses, with funds and teams focused on partnering with organizations such as BEAM Collaborative and working directly with diverse entrepreneurs to help them scale effectively as suppliers to large corporations as part of a global ecosystem.

Last but not least, all of these stakeholders across the demand and supply sides of the equation require a common data and analytics platform that can provide a common view of the region and its socioeconomic landscape. Furthermore, these teams require the ability to intersect their own data with that broader view provided by external data sources to gain a clearer understanding of how they compare, what their goals could or should be, and the best way to focus investment and initiatives to achieve them. Last but not least, these teams face onerous reporting requirements related to compliance mandates and pressure from other audiences that require an organized, automated approach.

How should dedicated supplier diversity teams use data to improve the success and impact of their programs and measure outcomes over time?

For all teams involved in the supplier diversity imperative, having access to rich, granular data sources and advanced analytics is critical to understanding all aspects of the demand and supply sides of the equation. The most important consideration is that every company is unique based on the following:

- Population demographics vary dramatically by region,

- Each region’s economy, or its industry drivers, are also very unique, and

- Every company faces distinct challenges and opportunities due to its performance goals, broader competitive landscape, global macroeconomic dynamics, and firm size/maturity.

As a result, there are three critical boundary conditions that dedicated supplier diversity programs need to achieve a measurement framework that is both ambitious and achievable, including:

- The Community “Denominator”

A sound measurement standard must incorporate the uniqueness of the surrounding community from a demographic and industry/economic perspective as the denominator, or quantitative view of what is possible in terms of diverse suppliers and possible impact metrics. - Corporate Performance Objectives

Without strong financial performance, both from a top-line and bottom-line perspective, companies cannot remain competitive or viable, which would render a dedicated supplier diversity program moot. To be relevant, dedicated supplier diversity programs must incorporate financial performance goals and inputs needed to achieve them to avoid diminishing returns, or unrealistic expectations regarding diversity goals that cannot be achieved without materially compromising performance objectives. - Comprehensive Supplier Diversity “Success” Variables

Dedicated programs need to evolve to a standard measurement platform that looks beyond diverse ownership as defined by SBA certifications to include a broader socioeconomic impact lens. This can achieve multiple positive outcomes, including broadening the aperture of the diverse supplier pipeline and gaining a full picture of a procurement strategy’s financial and socio economic impact, both internally and externally.

An objective, data-driven lens makes it possible to align diverse interests across the demand and supply side of the equation around the current state procurement investment portfolio compared to the relevant region(s) and industry(ies). This broader understanding of socioeconomic dynamics at a geo and industry level is key to understanding what is possible and establishing realistic goals for cross-functional teams. Furthermore, supplier diversity teams also require rich data and analytics to target specific opportunity areas for recruitment and growth, establish goals, and track progress and impact over time. From an impact standpoint, teams must be able to consider both internal financial performance goals and external stakeholder impact to balance the need to maximize ROI while managing risk and automating required reporting.

Based on these requirements, a viable approach to measuring and managing a dedicated supplier diversity program must include:

- Data Richness & Granularity

Providing more detailed visibility into the firm’s current state supplier ecosystem and procurement spend portfolio as well as what’s possible based on their industry dynamics and the geographic where they operate. This internal and market data must be at the geo/industry level and include other relevant factors beyond business owner certification–i.e., overall impact on GDP, diverse employees compared to regional workforce, pay equity compared to regional benchmarks, and healthcare coverage compared to industry standards. - Internal & External Data Combined

Achieving #1 requires easy, cost effective, and dynamic access to external socioeconomic data that can be intersected with internal company and supplier data to gain a full understanding of both the “denominator,” or what’s possible in the relevant supplier base versus current state suppliers. Furthermore, this view enables leaders to establish clear goals that are both ambitious and achievable while focusing procurement investments they’re making to bolster the diverse supplier pipeline where they will have the most significant ROI–return on investment and return on impact. - Dynamic, Operationalized System

Optimizing Supplier Diversity is not a one-and-done exercise for the C-suite and their cross-functional teams. Like all important business growth imperatives, the program requires proactive, relentless measurement and management that helps everyone understand how metrics are evolving internally with the current supplier ecosystem and externally in the broader marketplace and global economy. By understanding trends and what is working or failing to achieve desired goals, teams can stay ahead of risks and achieve growth mandates. They can also automate onerous compliance reporting that is currently done by disparate teams in a one-off way that is expensive and error prone.

Achieving these three components requires a platform that can provide an outside-in lens where each stakeholder has the ability to see data that is critical to their demand or supply side of the equation. It also requires the ability for each stakeholder team to achieve the same view of the socioeconomic landscape that is dynamically evolving, share relevant information, and track their joint goals and impact together over time.

The key to delivering on the promise of dedicated supplier diversity programs is to go beyond the cursory programs that now leverage only MWOB/VSOB certifications as a way of understanding supplier diversity and its resulting socioeconomic impact. More specifically, a next generation measurement standard for supplier diversity programs should be rebuilt from the ground up to consider the following metrics:

- Economic Contribution

This metric would provide an understanding of a company’s role in the economy, both locally and nationally, but understanding how it compares based on GDP, payroll, and employees as a portion of the total. This calculation can provide valuable context around its current impact on communities as well as its ability to drive change and endure risk. - Diverse Business Landscape

Looking at the percentage of available diverse businesses overall and across all major industry sectors, it is possible to gain a sense of how a company’s procurement portfolio aligns demographically versus what appears to be possible, both at a local and national level. - Diverse Ownership & Management

This broader evaluation would look at the full picture of diverse leadership, both on the board and executive team and broader management/ decision maker levels. Ideally, this evaluation would consider more than the board and C-suite, capturing a broader picture of management extending at least 1-2 levels down (e.g., SVP and VP level) to gain a fuller view of the company’s culture and leadership impact as well as its pipeline for the most senior level roles.

- Diverse Workforce

The ultimate goal for diverse supplier programs is to achieve broader socioeconomic impact on underserved populations and their communities. As part of this calculation, diversity should not be seen as an absolute number but rather in conjunction with the diverse population that surrounds it as well as other relevant factors, such as industry, business model, or organizational maturity. Moreover, the extent to which a company is able to achieve a diverse workforce should be derived as a function of what is possible and feasible given their unique situation. - Payroll Impact

A company’s role in hiring diverse workers and providing them and their families with a living wage is one of the most important roles any company plays in driving positive social impact. Understanding the relative payroll impact on diverse workers and extended family and community ecosystems at a more macro level is a key component for understanding the socioeconomic impact of dedicated supplier diversity programs. - Pay Equity

One of the most important factors perpetuating the racial wealth gap is pay equity. Median income, household income, and the pay equity gap varies materially by region and then within industries as well. Evaluating pay equity effectively relies on a company’s ability to understand a given company’s metrics in the context of those external metrics, or the relevant denominator, that concretely provide a boundary condition related to what is possible for each unique company’s situation. Looking at pay equity at more granular levels–i.e., at the management level and workforce or individual contributor level–can provide insight into where the most significant challenge and opportunity exists based on level of education, experience, and responsibility. - Healthcare Coverage

Health-related debt is the most crippling crisis in the U.S. that has become the most significant contributor to poverty, debt, unemployment, and homelessness, among other challenges. Recent studies have shown that the most significant contributor to low credit scores across the U.S. is directly tied to states where governors have opted out of the Affordable Care Act, or the support of medicaid for their populations. Moreover, one of the most important ways that businesses–both procurement teams and their expanded supplier ecosystems–can create positive socioeconomic impact and break the vicious cycle of poverty is through promoting healthcare coverage for their workers and achieving it in a way that is equitable across diverse populations. - Investment in Diversity-related Investments & Initiatives

This would include a myriad of initiatives, across workforce training and development, internal management training, support for employee tuition programs, investments in diverse businesses, as well as corporate social responsibility investments (e.g., number of employee volunteer hours and/or dollars contributed directly from the company and/or through employee matching gift programs).

TABLE

Beyond this core Equity Assessment for each company in the procurement portfolio, rich data and analytics can provide valuable contextual data for firms regarding the socioeconomic health of their surrounding communities. These factors can provide valuable cause and effect insights that impact the availability of a high quality workforce, supplier ecosystem, and/or customer base.

- General Socio Economic Landscape

A broader picture of the key factors that underpin a community’s viability can provide important context for corporations seeking to achieve successful, sustainable supplier diversity programs. Those factors include the overall racial and ethnic diversity of a community, educational attainment, unemployment rates, median income, home ownership, and business ownership. - Home Ownership

Homeowners have a median net worth that is 40x that of renters on average, making it the most significant source of wealth generation for most Americans. Looking at the racial wealth gap, it is evident that the gap in home ownership and access to credit are at the heart of the challenge. The difference in home ownership across racial lines is significant, with 70% of white Americans owning a home and only 42% of black Americans.

- Access to Credit

Another significant factor in the racial wealth gap is the difference in approval rates between black and white mortgage applicants across income levels. For example, looking at all mortgage applications nationally for borrowers with incomes of $150K-$200K, we see 74% approval rates for white applicants vs. 60% for black applicants.

- Public Health

Along with these key socioeconomic factors, a picture of a community’s health can also provide important insight into its ability to sustain itself and the companies that are operating within it, including the larger companies seeking to advance their dedicated supplier diversity programs.

Together, these richer impact metrics have the power to create a more comprehensive view of socioeconomic impact for dedicated supplier diversity programs. Furthermore, these metrics recognize a company’s unique situation based on its geographic location, industry, organizational maturity, competitive landscape, and other factors. Best of all, this external socioeconomic data is available and achievable in a way that enables each company and its diverse supplier program teams to gain unprecedented access to a more clear view of its current state, understand how they compare to industry peers and the markets where they operate, establish realistic future goals, and manage them dynamically over time.

What is the best way to get started in achieving a more successful diverse supplier program?

Every good initiative started with the right questions. Organizations need to be able to quickly gain access to a detailed picture of the markets where they operate and begin exploring their own stakeholder landscape. As part of this exploration, leaders are able to begin asking questions about their workforce, suppliers, and customers in the context of their surrounding communities, particularly related to diversity or demographic alignment, payroll equity and impact, access to education, healthcare-related resources, and other critical socioeconomic factors that can enable or compromise a firm’s sustainability, or long-term growth objectives.

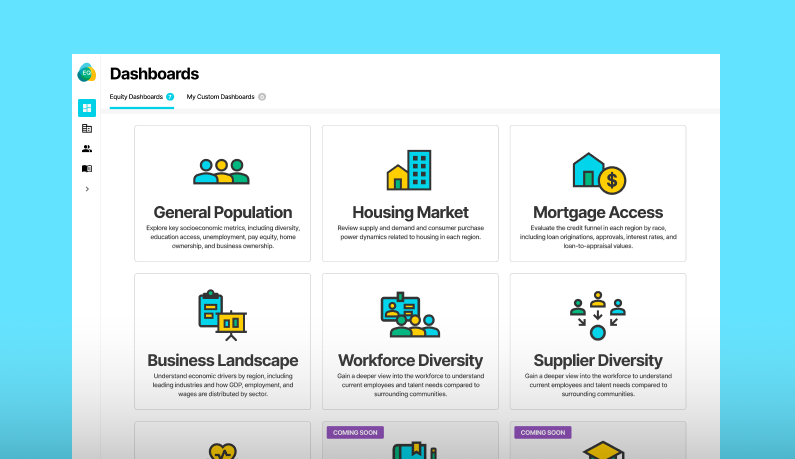

Equity Quotient is a SaaS technology platform focused on helping companies measure and manage their social impact in conjunction with their financial performance objectives. Powered by a rich data platform achieved by intersecting hundreds of data feeds from over a dozen sources, Equity Quotient provides a comprehensive picture of the socioeconomic landscape of every region across the United States. Dedicated supplier diversity teams on both the demand and supply sides of the equation are able to achieve their key objectives related to their dedicated supplier diversity programs and broader business objectives through exploring the following questions together:

- Power Strategic Planning for Growth

- Where is the next generation of growth going to be sourced and how will we support that growth with the right mix of stakeholder strategies across our workforce, supplier ecosystem, and target customers/ market segments?

- Which supplier sectors are most critical to supporting that growth and which are in a position to achieve greater diversity as part of our procurement strategy?

- Does the diverse supplier ecosystem have all of the ingredients it needs to support growth and scale, particularly from a financing and cash flow standpoint?

- What investments are needed by our organization and other public/private sector initiatives to ensure that healthy infrastructure is in place to support growth objectives now and into the future?

- Proactively Manage Risk

- What is our risk posture now and based on where we’re headed, particularly across our stakeholder portfolios?

- How do our employees compare to the broader workforce in our surrounding communities on relevant dimensions–diversity, educational attainment, household income, pay equity, health insurance coverage, home ownership?

- What is the business landscape of our surrounding communities, particularly related to industry growth drivers, workforce diversity, and supplier diversity?

- How do our surrounding communities fare from a public health and education standpoint, and are they in a position to foster the stakeholder portfolios we need to underpin our growth?

- Will our suppliers have what they need to support their growth from a workforce standpoint?

- Is the supplier landscape in our community and across the U.S. in a position to support our operations and avoid disruption?

- What initiatives might we take to proactively address potential risks?

- Automate Compliance Reporting

- Do our teams across HR, Finance/Procurement, GRC, and other parts of the organization have everything we need to achieve reporting requirements, from both regulatory mandates (SEC disclosures), market pressures, and other stakeholder-led initiatives (Annual Impact Reports)?

- Beyond our own internal data, where can external data and analytics regarding our surrounding communities and target markets provide valuable insights and inputs into our reporting strategy and execution across the organization?

- Could a centralized data source powering all of our disparate reporting requirements help our teams save time and money while achieving a more efficacious outcome and focus our teams on higher value activities?

After answering these questions and devising a plan for growth on both the demand and supply sides of the equation, it is time to operationalize that plan and track how performance and impact track to defined goals over time. Continuously checking in on plan versus actual performance on shared goals can help teams stay committed to strong execution success in the face of inevitable change. Trial and error are part of every business and every ambitious endeavor. Having the right data and analytics to help teams remain objective and aligned in evaluating challenge and opportunity can be the difference between success and failure.

Meet Equity Quotient

We increase access to socioeconomic data to shape a thriving economy inclusive of the people that drive it.

Humanizing Data. Catalyzing Growth.

Equity Quotient is an AI-powered stakeholder intelligence platform that aggregates a wide range of socioeconomic data into easy-to-use dashboards to help leaders can make more informed decisions to meet both regulatory and market-driven pressure.

We are charting the future of inclusive AI with our creation of a proprietary data platform, ML-powered analytic model, and use of other advanced AI technologies to create a large language model and make outputs more consumable with natural language processing and interactive visualizations.

With Equity Quotient, executives across sectors better understand their workforce, suppliers, customers, and community to measure impact, automate compliance, and optimize growth.