Banking

Explore our Case Studies:

Banking

Explore our Case Studies:

Global Investment Bank

Scenario

Global investment bank needs to validate efficacy of impact debt funds.

Client Challenge

Impact debt funds are becoming a significant component of the bank’s business, but the Chief Strategy Officer and Head of ESG lack data and analytics needed to evaluate the S in the ESG to ensure their portfolio companies are aligned with impact-focused investor goals.

EQ Solution

Equity Quotient’s automated solution will help the bank’s leaders run advanced analytics on portfolio company stakeholder data compared to the regions where they operate. The platform’s AI-powered, advanced insights will provide an understanding of each company’s current risk posture, avoiding $1M in SEC fines and other reputational damage.

A dashboard that optimizes decision making

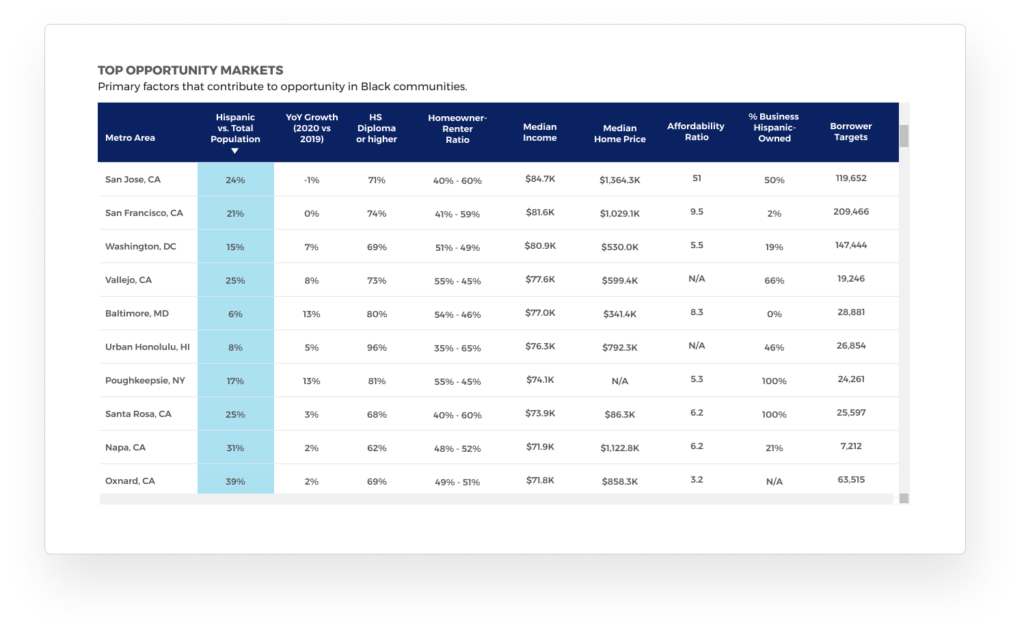

Explore your market

Dashboards powered by AI-generated insights from rich public & private data sources provide a heatmap profiling debt portfolio risk and opportunity.

Track your portfolio

Equity Quotient dashboards provide stakeholder insights for each portfolio company in the fund and helps aggregate financial, impact, and compliance metrics.

Automated reporting

Data can be integrated with bank systems to automate reporting for for SEC, ESG, LPs, portfolio companies, and other stakeholders.

Turn insights into action and impact!

Automate reporting

to save time and money, improve efficacy of audited S data.

Align stakeholders

to drive stronger investment returns for impact portfolio companies & fund.

Evolve debt fund allocations

based on socioeconomic insights.