Banking

Explore our Case Studies:

Banking

Explore our Case Studies:

Consumer Financial Services Provider

Scenario

National consumer-focused financial services provider seeking to improve ESG S impact posture to drive growth.

Client Challenge

Head of ESG for national banking and insurance provider to military veterans and their families seeking to establish and track current state S in ESG metrics with goal of improving efficacy of data powering ESG posture and drive strategies for sustainable, resilient growth across the country.

EQ Solution

EQ equity dashboards provide a comprehensive overview of the company’s stakeholder portfolios–employees, suppliers, customers, and targeted communities–based on rich data and advanced analytics to power a platform for decision making and compliance reporting at cost of 10% of building in-house.

A dashboard that optimizes decision making

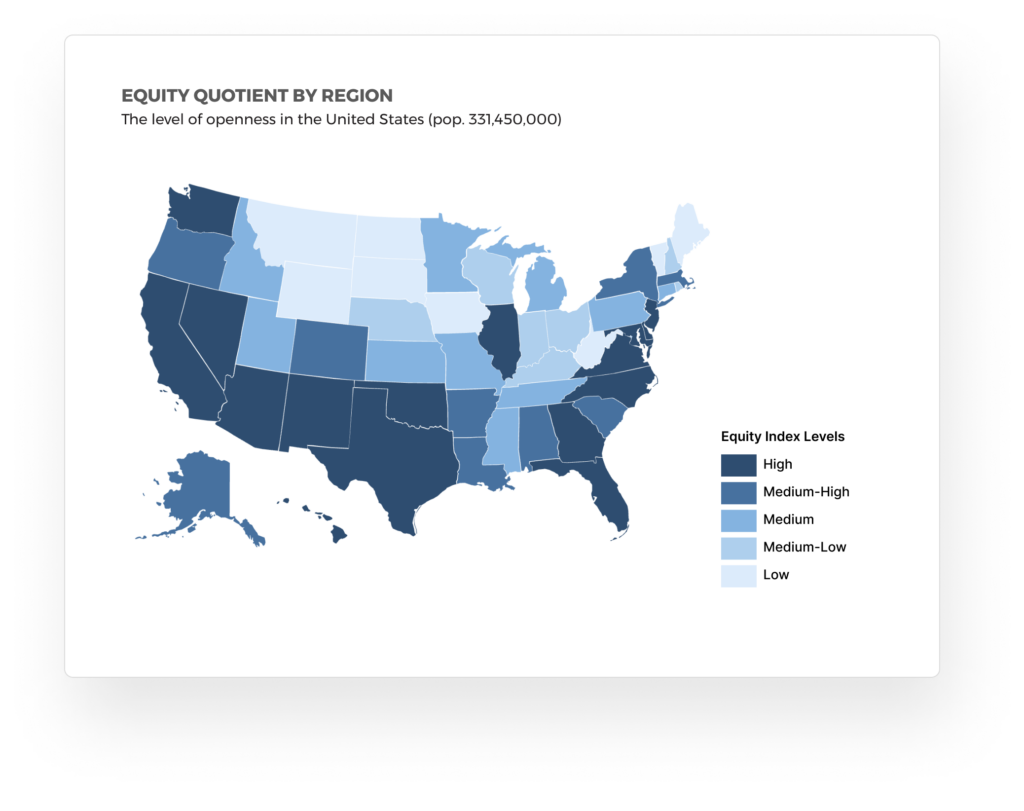

National EQ index

Advanced analytics provide summary view of how the firm’s customer portfolio aligns to its markets from a demographic standpoint across the country.

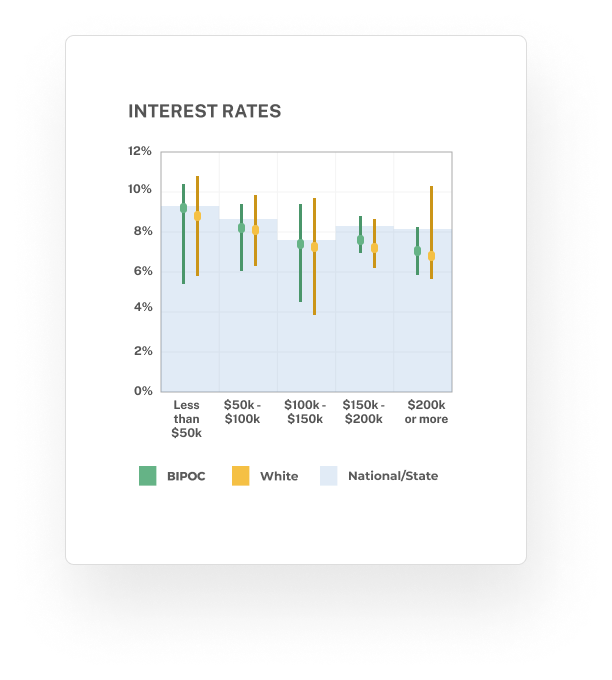

Explore interest rate variance

Insight into pricing bands on interest rates and insurance premiums by race/ethnicity for every level of income bracket and loan/policy amounts compared to industry.

Unpack approval funnels

Loan/policy originations compared to the target market population combined with approval rates leverage ratios by race/ethnicity.

Turn insights into action and impact!

Shift marketing

to build stronger funnel in top opportunity regions.

Hire diverse talent

that aligns to its opportunity markets to boost originations and lower defaults.

Adjust AI models

that underpin automated decisions throughout the funnel for loans and policies.