Banking

Explore our Case Studies:

Banking

Explore our Case Studies:

National Mortgage Lender

Scenario

National mortgage lender must drive pipeline growth through tapping new demographics.

Client Challenge

Current market conditions are constraining the bank’s ability to drive growth. Chief Marketing Officer and Chief Strategy Officer needed to understand the opportunity to address 2nd generation Hispanic populations across the US where attainable housing stock is available by county/metropolitan area.

EQ Solution

Equity Quotient delivered the EQ Opportunity Index to the bank’s to inform the exec team’s FY2023 strategic planning. Powered by a rich diversity data platform, the bank is executing a targeted marketing program and evolving loan officer demographics to expand pipeline by up to 20% and reduce default rates by up to 1.7%.

A dashboard that optimizes decision making

Supply & demand summary

Proprietary analytic models enable quick view of high opportunity areas in terms of borrower targets and housing stock.

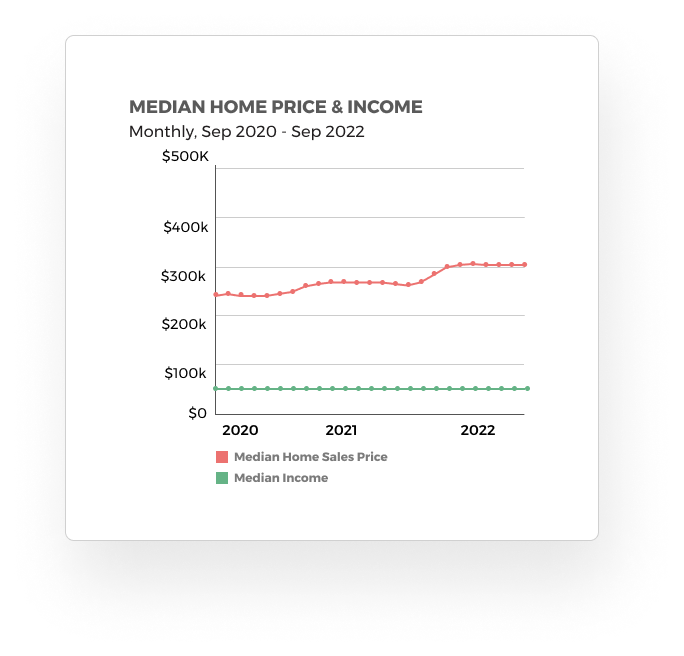

View real-time housing supply

Rich data from US Census, Zillow, and HMDA provides dynamic insights into housing economics by region.

Benchmark mortgage credit funnel

Loan originations and acceptance rates by income and housing price across racial/ethnic groups.

Turn insights into action and impact!

Optimize marketing

to align with top growth regions.

Hire loan officers

in target regions that align demographically to capture new leads.

Adjust AI models

that underpin the credit funnel to overcome bias and expand originations.