Creating a Virtuous Circle With Affordable Housing Preservation

How Mosser Capital is investing in undervalued markets to achieve growth & impact

Creating a Virtuous Circle With Affordable Housing Preservation

How Mosser Capital is investing in undervalued markets to achieve growth & impact

Jim Farris, Co-founder & CEO of Mosser Capital

Christina Van Houten, Co-founder & CEO of Equity Quotient

October 2023

The Affordable Housing Crisis in America

Affordable housing is one of the most critical challenges facing the United States:

- Nationally, there is a shortage of more than seven million affordable homes for our nation’s 10.8+ million extremely low-income families. (NILHC, 2023)

- There is no state where a renter working full-time at minimum wage can afford a two-bedroom apartment. (NILHC, 2023)

- 70% of all extremely low-income families are severely cost-burdened, spending more than half their income on rent. (NILHC, 2023)

- Evictions of families are on the verge of exploding due to housing costs far outpacing increases in wages. (NPR, June 2023)

- Supply chain and labor inflation combined with rising interest rates increased construction costs by 30%-50% between 2021 and 2023. (Bloomberg, July 2023)

These challenging dynamics have increased the importance of preserving existing affordable housing stock. The U.S. faces an unprecedented crisis that is compromising economic growth and the myriad of factors that underpin it. (New York Times, Feb 2020)

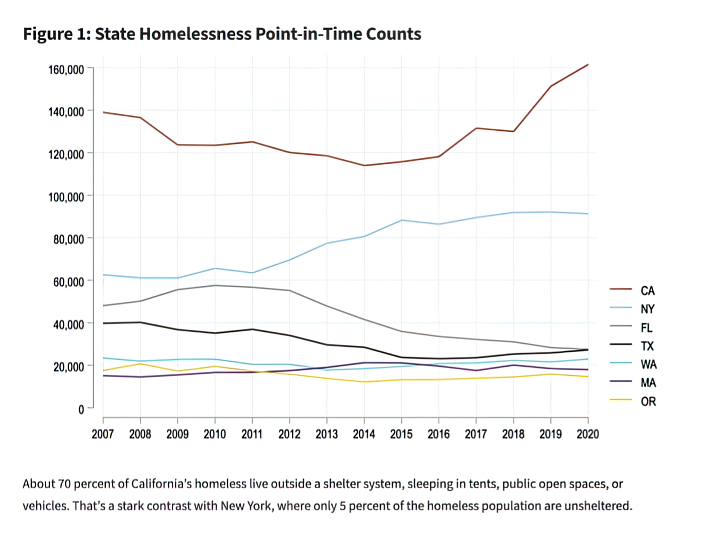

Spotlight on California’s Challenge

Nowhere is this challenge more acute than in California. According to Equity Quotient’s Housing Market dashboard, the average home costs 8x the state’s median income. This puts affordable housing out of reach for a majority of California families. Meanwhile, California’s homeless rate is the highest in the country, with over 160,000 individuals experiencing homelessness. The combination of high cost of living, lack of affordable housing, and high poverty rate has created significant socioeconomic challenges across the state and compromised the quality of life and growth for all citizens.

Mosser Setting the Standard

In the midst of this daunting challenge, one real estate company stands out for its ability to unlock the power of strong financial performance and social impact: Mosser Capital. Mosser was originally founded in 1955 as a family-owned business focused on uplifting affordable housing units in San Francisco’s working neighborhoods, Mosser Capital has now grown its vertically integrated investment and operating platform to a $1.5B business with operations in Oakland, Los Angeles, and other parts of California.

We are proud of the enormous growth in our portfolio over the past 12 years that has increased our ability to positively impact more communities and the lives of the residents we serve. Our goal is to continue bringing additional institutional capital into investing in the small-to-medium sized property workforce housing segment, which has been traditionally overlooked by institutional investors. We are attracting investors that are interested in affordable housing, many of which want to have a measurable social impact as a result of the dollars they invest in the residential housing sector. As we look forward to raising our second discretionary fund vehicle focused on workforce housing in California we are excited to see what new investors will look to partner with us as we acquire and improve properties in the missing middle sector of the housing market.”

Jim Farris, Mosser’s Co-founder and CEO

Mosser Capital’s success in the affordable housing space is no accident; everything about its business strategy and operational discipline is intentional. Here are a few examples that have catalyzed and sustained its success:

Going Where Others Fear to Tread–Capitalizing on a Compelling, Untapped Strategic Investment Opportunity

Growing the ecosystem of affordable housing has been Mosser Capital’s raison d’ etre. They have gained a competitive advantage by focusing on their target customer: working families seeking safe, high-quality, positive community environments at an affordable price. This enabled Mosser Capital to break the mold that has prevailed in lower-income neighborhoods, traditionally run by slumlords that perpetuated the vicious cycle of socioeconomic challenges. As a result, Mosser Capital is one of the only institutional investors that have figured out how to do affordable housing well in a sustainable way over its 68 year history.

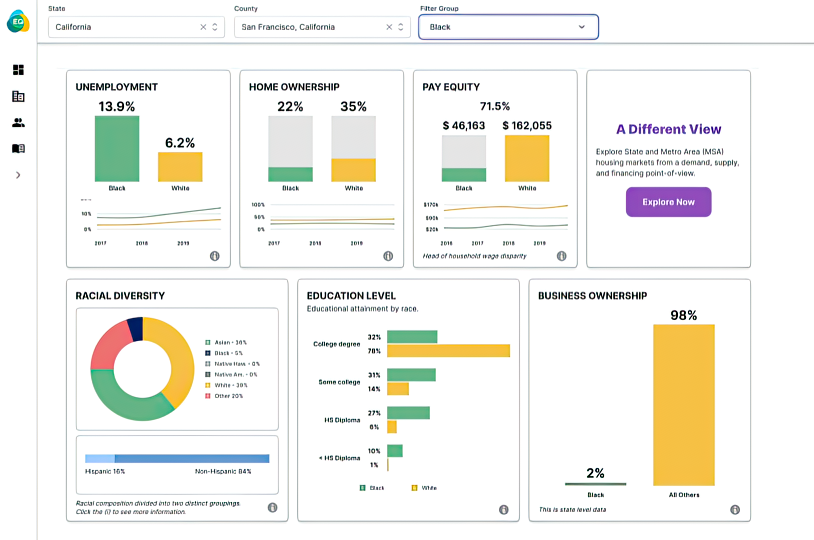

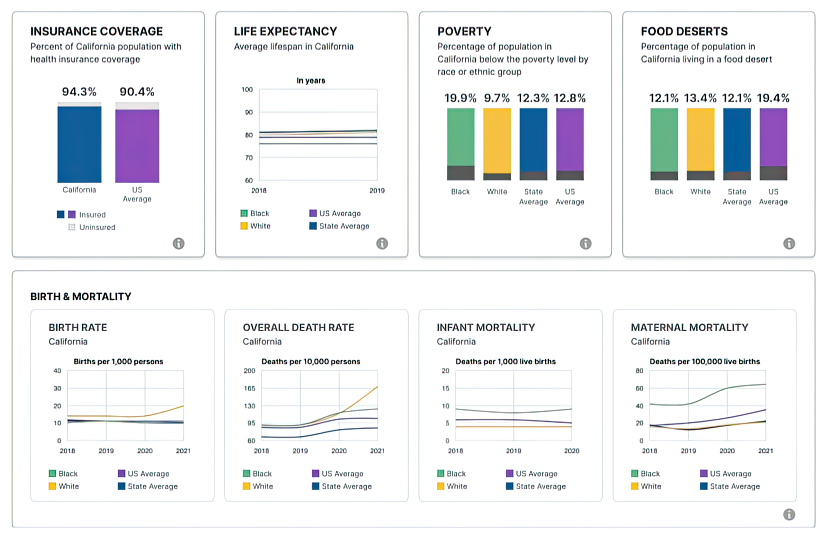

Equity Quotient’s General Population dashboard helps bring to life the socioeconomic landscape for Mosser Capital, providing valuable context for both evaluating tenants in current regions and exploring new markets for expansion.

Measuring What Matters–Health, Safety & Other Quality of Life Metrics

Mosser is committed to measuring all aspects of their business and the communities where they operate, particularly related to the socioeconomic landscape of their tenants. They also track public health, environmental, and safety metrics to proactively mitigate risks and unlock new top and bottom line growth. This focus on the “whole tenant” and “whole community” has paid big dividends, as evidenced by Mosser Capital’s strong financial performance with Net investor returns of over 16% IRR and 1.5x return on equity in 50 realized transactions with roughly 2,000 workforce housing units.

Overcoming the Credit Bias–Proactively Serving as a Financial Guarantor and Rental Assistance Facilitator

Mosser Capital proactively works to overcome the system bias that exists throughout the credit funnel for working families and their communities. Equity Quotient’s Mortgage Access dashboard gives Mosser access to critical data such as approval rates by level of income across race/ethnic lines. It also provides insight into interest rate disparities and mortgage-to-home value ratios. Mosser addresses these disparities by incorporating access tools such as “The Guarantors”, a bond program that provides an affordable security deposit alternative to renters. Mosser Capital utilizes Esusu in order to help their residents build credit with on-time rental payments. Esusu also maintains a dedicated fund that can pay several months of rent on behalf of a resident in need.

Achieving Demographic Alignment–Humanizing Operations to Catalyze Growth

Mosser Capital proactively works to overcome the system bias that exists throughout the credit funnel for working families and their communities. Equity Quotient’s Mortgage Access dashboard gives Mosser access to critical data such as approval rates by level of income across race/ethnic lines. It also provides insight into interest rate disparities and mortgage-to-home value ratios. Mosser addresses these disparities by incorporating access tools such as “The Guarantors”, a bond program that provides an affordable security deposit alternative to renters. Mosser Capital utilizes Esusu in order to help their residents build credit with on-time rental payments. Esusu also maintains a dedicated fund that can pay several months of rent on behalf of a resident in need.

Recent studies reinforce that an intentional focus on diversity and equity generates compelling social and financial results.

- Mortgage Banking

The difference in default rates between minority and white borrowers (1.7 percentage points) disappears when the loan officer is also a minority.Meanwhile loan origination completions and other relevant success metrics also improve materially to ultimately open the eligible borrower pool by 20%. 1

- Consumer Products & Retail

At $3.9 trillion, U.S. BIPOC spending power is larger than Great Britain’s GDP. Tapping into that market requires companies to engage the 57% of consumers loyal to brands that demonstrate concrete commitment to social equity across all stakeholders. 2 Meanwhile, retailers such as Walmart have found stores realize stronger performance when their staff closely reflects their communities.

- Healthcare

When Black patients are treated by Black doctors, adult mortality rates declined by nearly 20% while infant mortality rates declined by ~50%. 3

- Education

When Black students are exposed to just one Black teacher, graduation rates improve by 40% while those pursuing college increases by 15%. This increase could meaningfully address the wealth gap as college graduates earn 2-3x those with high school diplomas or less. 4

Being Transparent & Accountable to Stakeholders–Impact Reporting

Mosser Capital’s vertically integrated team has always embraced purpose as part of its performance equation. Sharing the results they’re achieving for their stakeholders, including their investors, tenants, suppliers, employees, and broader communities–is core to their culture and values.

Mosser’s intentional strategies that have aligned stakeholders demonstrate the opportunity to unlock new opportunities and drive sustainable growth,” says Christina Van Houten, CEO of Equity Quotient. “Jim and I are excited to partner in achieving a technology platform that will catalyze, automate, and inform Mosser Capital’s next generation of initiatives that will continue to be focused on affordable housing preservation.”

The opportunity to achieve strong performance and social impact has never been greater or more needed in our economy. Bold companies like Mosser Capital that have turned purpose into a competitive advantage have so much to teach us about achieving long-term sustainable growth. By incorporating stakeholder intelligence into every aspect of their strategy and execution, Mosser Capital demonstrates how tremendous progress can be achieved through a series of small, intentional actions.

Endnotes:

- Banking Academic Research Paper, “The Impact of Minority Representation at Mortgage Lenders,” W. Scott Frame, Ruidi Huang, Erik J. Mayer, Adi Sunderham, May 9, 2022.

- Deloitte, “Authentically Inclusive Marketing,” C. Brodzik, N. Young, S. Cuthill, N. Drake, October 19, 2021.

- SSRN, Physician-Patient Race-Match Reduces Patient Mortality, June 26, 2020, A. Hill, D. Jones, L. Woodworth while infant mortality rates could be reduced by 39%-58% (CNN, August 20, 2020)

- Whyy, “Want to Support Black Students? Invest in Black Teachers,” Feb 19, 2021 and Time, Aug 11, 2020.