The EQ IQ series

Navigating DEI Programs Post Affirmative Action

A path forward for companies dedicated to the value of diversity following the Recent SCOTUS Ruling on SFFA v. Harvard and Attorneys General Cease & Desist Letter to Fortune 100 CEOs

The EQ IQ series

Navigating DEI Programs Post Affirmative Action

A path forward for companies dedicated to the value of diversity following the Recent SCOTUS Ruling on SFFA v. Harvard and Attorneys General Cease & Desist Letter to Fortune 100 CEOs

On July 13th, Attorneys General from 13 states issued a cease and desist letter to CEOs of Fortune 100 companies, extending the reach of the recent Supreme Court ruling rendering quotas at academic institutions unconstitutional. With DEI programs now under fire, corporate leaders are now in a position where they must rethink how they have achieved diversity in the past. To achieve sustainable growth and address compliance pressures, leaders are often faced with complex and often competing interests as they navigate an ever-changing world inside and outside of their organization.

Regardless of how one interprets the law in its current state or how it will inevitably evolve, one thing is for certain—the ruling, and the regulatory and market pressures that surround it, require companies to enrich their approach to executing programs needed to compete and grow.

With this paradigm shift, Equity Quotient recommends that every organization should begin its journey to achieving sustainable diversity to drive growth and impact with the following 5 steps process:

- Eliminate quotas.

- Broaden decision criteria to include socioeconomic factors.

- Leverage rich data to fortify your decision lifecycle.

- Add context to dynamically evaluate stakeholder portfolios.

- Automate reporting and track outcomes.

Let’s dive into each of these initiatives to better understand how to take action.

1. Eliminate quotas.

The court’s opinion was clear that diversity is a laudable goal that can and should be pursued by organizations. However, the court also clarified that the way that diversity has been achieved historically–primarily through establishing quotas and devising processes for achieving them–is no longer permissible.

What does that mean for companies?

Organizations are now required to consider diversity through a broader, more nuanced lens. That lens should include robust factors that can help profile candidates and evaluate them based on rich attribution regarding their demographics, skills, and other relevant capabilities. That information can help achieve more thoughtful analysis regarding fit to a role as well as fit within a broader, diverse team of talent needed to help the organization achieve sustainable growth. Leaders will require rich data to characterize the team’s current mix of diverse perspectives and talents as a portfolio of stakeholders, or how each member of the team has complementary, distinct qualities that contribute to the organization’s objectives.

2. Broaden decision criteria to include socioeconomic factors.

As part of analyzing candidates and teams, organizations will need to expand the data they are incorporating into their decision-making. To maximize productivity, innovation, customer success, and ultimately growth, leaders must focus on achieving a strong, sustainable workforce that attracts the best talent available based on their region and industry.

Going forward, rich socioeconomic data on the markets or communities where a company operates is a critical piece of the data required for sound workforce strategy and execution. Every organization is different, every industry’s competitive landscape is unique, and every region where a firm operates is distinct. Understanding the relevant “denominator” for your business based on these important factors is critical to understanding the current state of your employee stakeholder portfolio compared to the surrounding community and the customers that those employees engage.

Extensive studies across multiple sectors (e.g., banking, healthcare, retail, and education) have demonstrated the concrete benefits of achieving stronger demographic alignment across employees, suppliers, customers, and the community. Those benefits include both improved financial results and social outcomes. For example, in consumer banking that alignment results in reduced default rates by nearly 2% and expanded loan originations by approximately 20% while in healthcare it reduces mortality rates by 50% with infants and 20% in adults. As a result, understanding the interplay between workforce diversity versus customer and community diversity on all relevant demographic dimensions is the key to proactively managing risk and driving sustainable growth.

Rich socioeconomic data that provides insights into the communities where you operate and other markets across the U.S. can enable visibility into unemployment rates, levels of educational attainment and access, median pay by industry and household income, health insurance coverage rates, home ownership, and other social KPIs. These socioeconomic factors can help companies begin to understand the full picture of their employee’s social and economic well-being versus the broader community, including their diverse supplier ecosystem, customer base, and the broader market they’re addressing.

3. Leverage rich data to fortify your decision lifecycle

Several external pressures combine to require companies to gain a rich understanding of their socioeconomic landscape to better understand their stakeholder portfolios, including their workforce, suppliers, customers, and the surrounding community. Beyond the recent SCOTUS ruling on SFFA v. Harvard and mounting pressure on all organizations to eliminate race-based decisions and quotas, companies are facing a myriad of other regulatory and market-driven mandates that require rich socioeconomic data to power their full decision-making continuum. In recent years, that pressure has been mounting based on SEC disclosures, ESG-related reporting for investors, New Market Tax Credit reporting real estate development, health equity mandates for hospitals and health systems, FAIR Lending and CRA requirements for banks, and other Federal funding guidelines such as Justice 40.

These dynamics have created a need for companies to gain rich access to data on their surrounding communities to inform and underpin their entire decision-making process. From a workforce perspective, this data can provide a clearer lens of what the talent landscape looks like compared to their current employees. Leaders can also explore diversity, pay equity, and other relevant factors for their industry, both locally, in peer communities, and nationally. This context can help leaders understand how they benchmark, proactively see risks that might impact their business, and also discover opportunities they might not have otherwise seen.

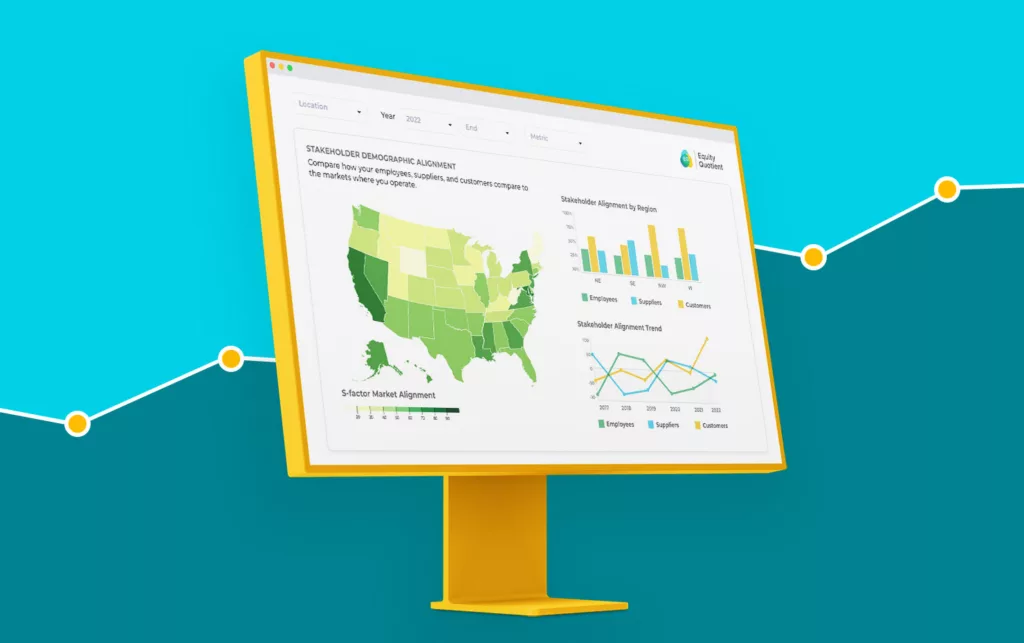

4. Add context to dynamically evaluate stakeholder portfolios

In this new environment, leaders must capitalize on socioeconomic data in a way that helps them understand their workforce more deeply. Integrating enterprise information on current employee demographics and other relevant attributes with external data can help organizations see how they align with customers and the surrounding community–not just at a point in time but dynamically as stakeholders are evolving both internally and externally.

As noted above, the “denominator” matters–i.e., the unique geography and the socioeconomic landscape where a firm operates are material to its stakeholder strategies across the workforce, suppliers, customers, and the broader community. Furthermore, a company’s industry, maturity, global competitive landscape, and business model are also critical to consider. Taken together, leaders face daunting complexity as they navigate the pressures of maximizing performance for shareholders, meeting compliance mandates, and navigating demanding, fickle markets. Firms must have the freedom to make decisions continuously that can help their organizations thrive, both in the short and long term, based on a myriad of complex factors.

Given these often competing pressures, what are leaders to do?

The first-order challenge is to harness the complexity by adding a method to the madness. The key to remaining relevant and viable is to make all of this complexity more consumable and to leverage data in a way that is seamlessly embedded into organizational decision-making. Injecting socioeconomic data as context across the operational continuum can help leaders see their stakeholder portfolios more clearly and guide strategy, investments, and execution in a way that can create a competitive advantage.

Rich socio-economic data across all regions in the U.S. can inform what’s possible from a workforce strategy perspective to help leaders manage risk, expand the pipeline, and improve talent sustainability. This data can also inform initiatives that can improve retention, expand innovation, drive productivity, improve customer success, and ultimately fuel growth.

5. Automate reporting and track outcomes

Historically, many or even most companies have endeavored to engage this kind of data periodically. In some cases, they have hired consultants to produce offline reports that provided interesting insights at a point in time but then tended to sit on a shelf. In other cases, analysts from HR, Finance, and/or Legal might be pulling this kind of information in an ad hoc way to inform one report or another for a particular function. While these initiatives are endeavoring to address pieces of the challenge and opportunity at hand, they have imposed significant costs on companies yet yielded suboptimal results.

To capitalize on the opportunity that socioeconomic data can provide to an organization, it must become a seamless, dynamic, and operationalized ingredient across all organizational decision-making. All leaders and their teams–across sales and marketing, product and services, and administrative functions–must be able to access the same “version of the truth” to align around their assumptions and come together to proactively address risks and pursue new initiatives to drive growth. Meanwhile, company stakeholder portfolios are the most mission-critical assets in a service-focused economy. Employees, suppliers, customers, and the surrounding communities where they operate are living, breathing organisms that are relentlessly changing.

How would organizational leaders utilize this data day to day?

Socioeconomic data must be relentlessly available to inform and validate investment decisions, from workforce diversity and development to supplier diversity programs to marketing campaigns to customer success. Furthermore, external data can also be intersected with internal stakeholder data to automate risk monitoring, particularly with the explosion of artificial intelligence and the potential for adverse stakeholder impact in the systems it informs (e.g., resume review models, patient care path recommendation systems, credit scoring applications).

Last but not least is compliance reporting for both government and market-based demands. This reporting impacts all parts of the organization and is required continuously for a myriad of diverse audiences, whether it’s for planned annual impact reports, quarterly SEC filings, ESG surveys, or more ad hoc requests from consumers, investors, and/or regulators.

In this new world order, companies have no choice but to achieve a dynamic approach to decision-making to maximize sustainable growth.

As we move forward following the SCOTUS SFFA v. Harvard ruling regarding Affirmative Action and its aftermath, all organizational leaders are faced with the challenge of navigating uncertainty about what to do about their DEI initiatives. Meanwhile, they are also charged with maximizing growth and other impact-related KPIs in a world where diversity is an immutable, mission-critical factor, from both a risk and opportunity standpoint. Amid this daunting confusion and overwhelming uncertainty, one thing is clear–leaders must have significantly richer data on their stakeholders and the world where they operate to gain clarity around their current state and chart a growth path.

Meet Equity Quotient

We increase access to socioeconomic data to shape a thriving economy inclusive of the people that drive it.

Humanizing Data. Catalyzing Growth.

Equity Quotient is an AI-powered stakeholder intelligence platform that aggregates a wide range of socioeconomic data into easy-to-use dashboards to help leaders can make more informed decisions to meet both regulatory and market-driven pressure.

We are charting the future of inclusive AI with our creation of a proprietary data platform, ML-powered analytic model, and use of other advanced AI technologies to create a large language model and make outputs more consumable with natural language processing and interactive visualizations.

With Equity Quotient, executives across sectors better understand their workforce, suppliers, customers, and community to measure impact, automate compliance, and optimize growth.